Dear Friends,

On behalf of all of us at BGSA Holdings and Cambridge Capital, we wanted to share some highlights of BGSA Supply Chain 2021. For those of you who joined us, we hope you had a great time.

This was a unique experience. We were sorry that we could not host you in Palm Beach at the Breakers, as COVID-19 caused our 15th annual conference to go virtual. Nevertheless, the silver lining was that we had the opportunity to include an even broader-reaching mix of supply chain leaders, including speakers such as Moderna CEO Stephane Bancel, USPS Postmaster General Louis DeJoy, and over 30 CEOs, CSCOs, and industry leaders. In addition, we benefited from the active participation of close to 200 select registrants, including CEOs, owners and entrepreneurs, everywhere from Switzerland to South Africa to Australia.

A Representative List of Speakers and Industry Leaders

For those of you who were not able to attend this year, we wanted to summarize some of what you missed.

First, let’s start with the data.

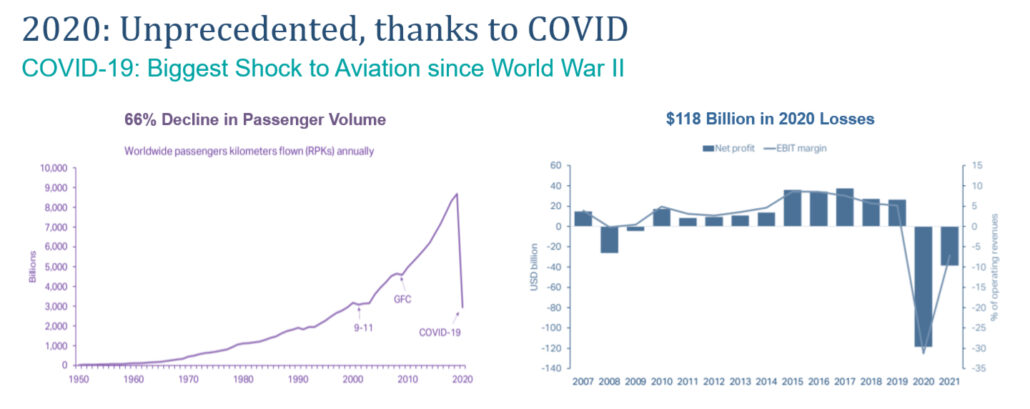

On the one hand, 2020 delivered the biggest gut-punch to the economy, and in particular to the transportation sector, since World War II. The airline industry, for instance, suffered a 66% decline in passenger volume, and $118 billion in losses.

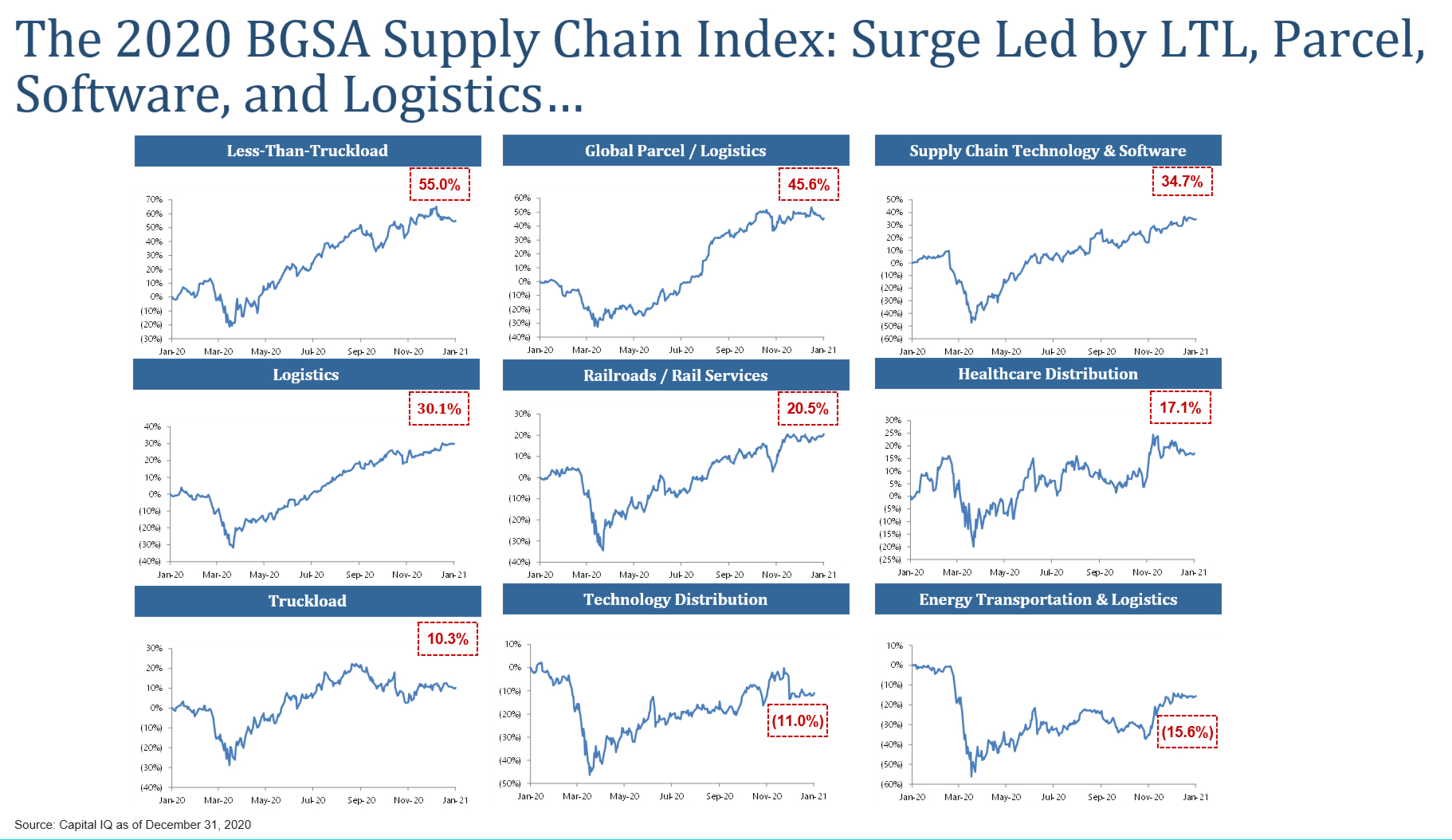

On the other hand, 2020 was a surprisingly good year for the supply chain public markets. In aggregate, the BGSA Supply Chain Index increased 26% in 2020. Nearly all sectors went up, headlined by LTL, parcel, and supply chain software.

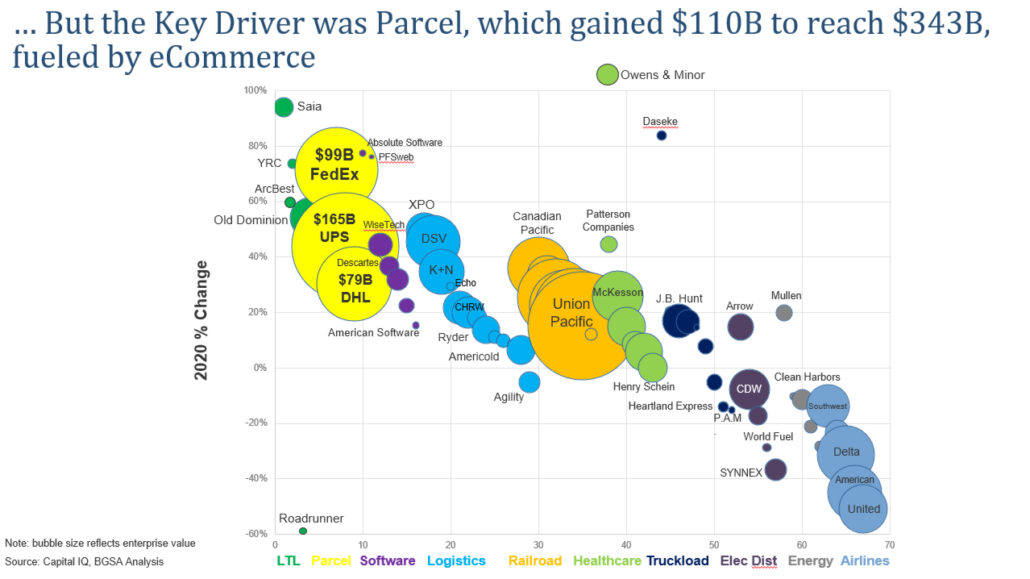

The key driver was ecommerce. The three parcel giants, UPS, Fedex and DHL, gained $110 billion in market value to reach $343 billion. As people shifted from office to work-from-home (WFH), and transitioned from retail to e-tail, we saw a surge in ecommerce, LTL, parcel, and last-mile shipment growth.

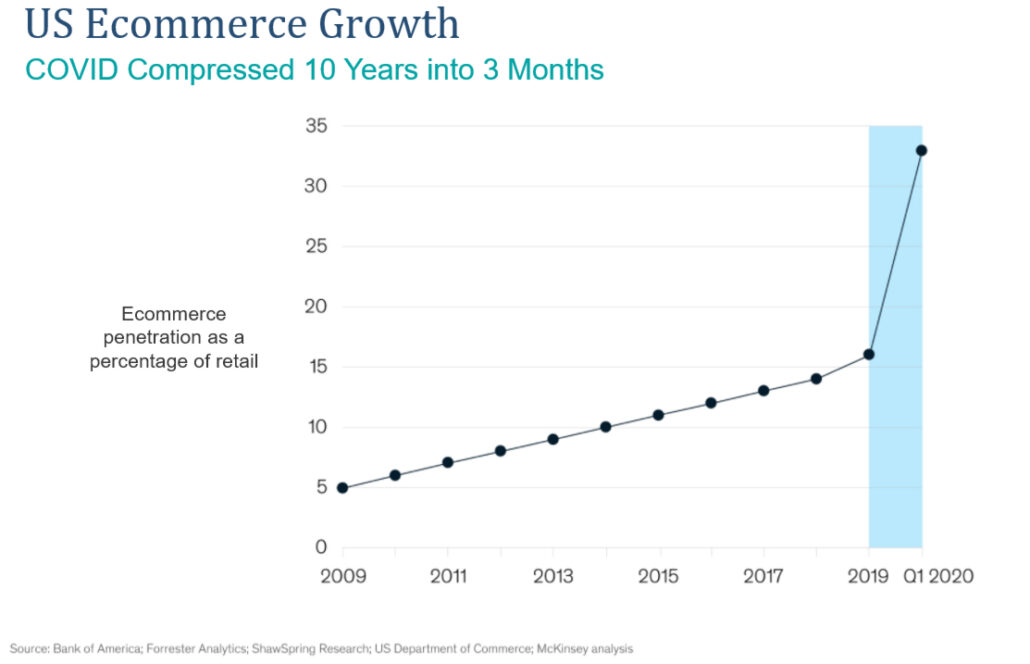

COVID compressed a decade of projected ecommerce growth into a quarter. The pandemic accelerated an underlying trend, and provided a boost to logistics companies tied to ecommerce, such as ecommerce fulfillment, parcel, LTL, last-mile, and reverse logistics.

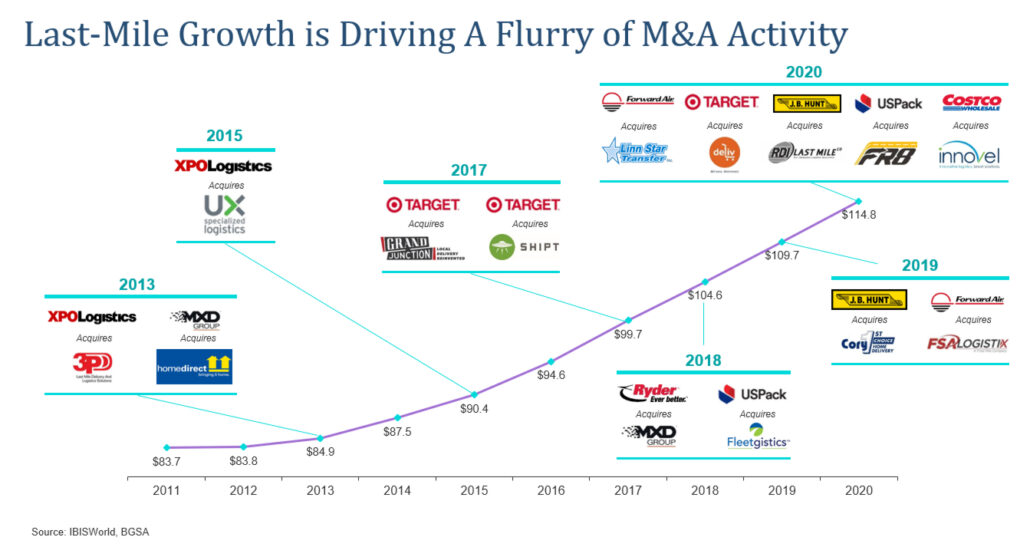

As a result of this spike in ecommerce, we are also witnessing a surge in deal-making in downstream logistics services. For instance, the boom in M&A for last-mile logistics continues.

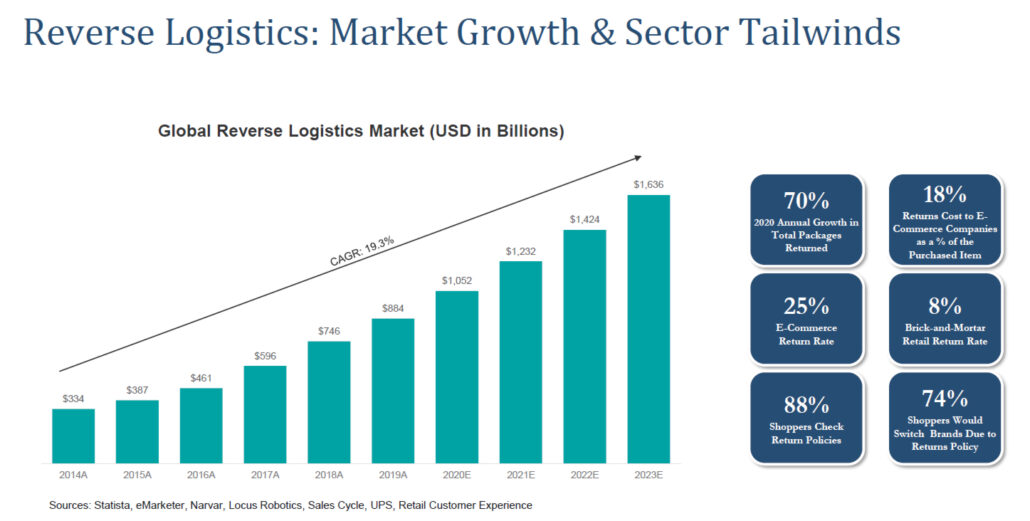

Similarly, reverse logistics is continuing to increase in importance. As the market expands to $1 trillion worldwide, the 25% ecommerce return rate is fueling 19% annual growth.

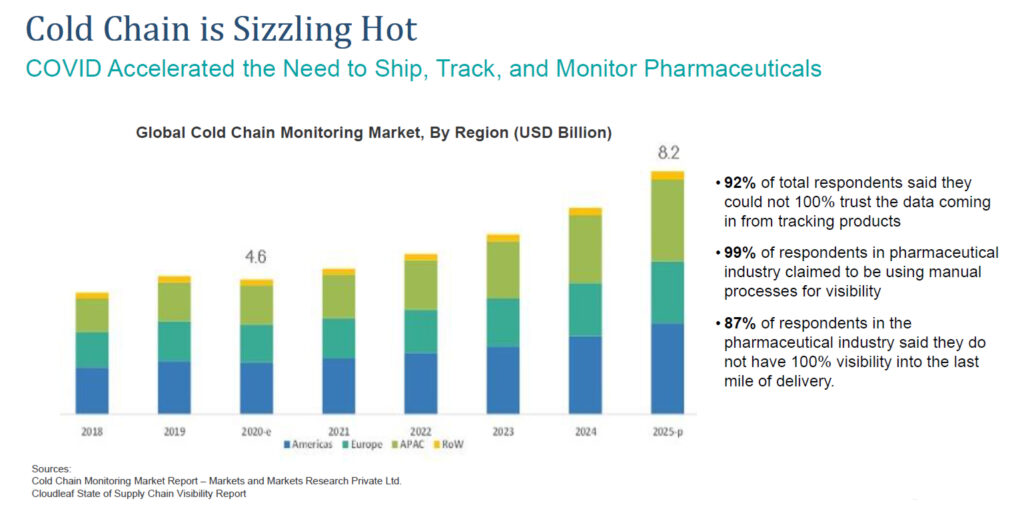

Another ripple effect emerges from COVID: cold chain technology. As pharmaceutical giants race to distribute vaccines for 8 billion people worldwide, the supply chain has become the weakest link. How will governments ensure their populations receive vaccines? And how to prevent spoilage? The answer lies in cold chain logistics. And the technology to support it has continued to grow in importance.

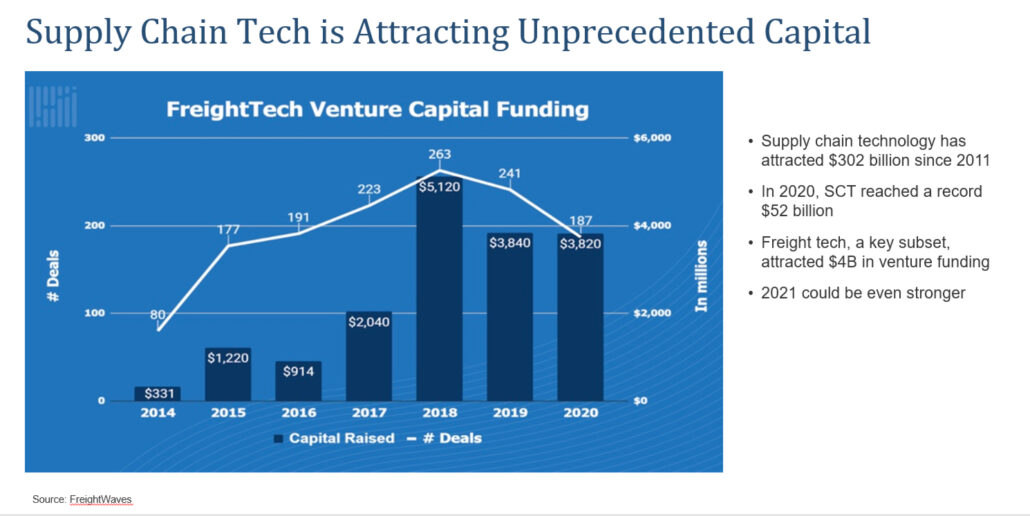

As a result, the market has never been stronger for supply chain technology. Capital continues to pour into winning companies in this sector. Freight technology, for instance, attracted $4 billion in 2020.

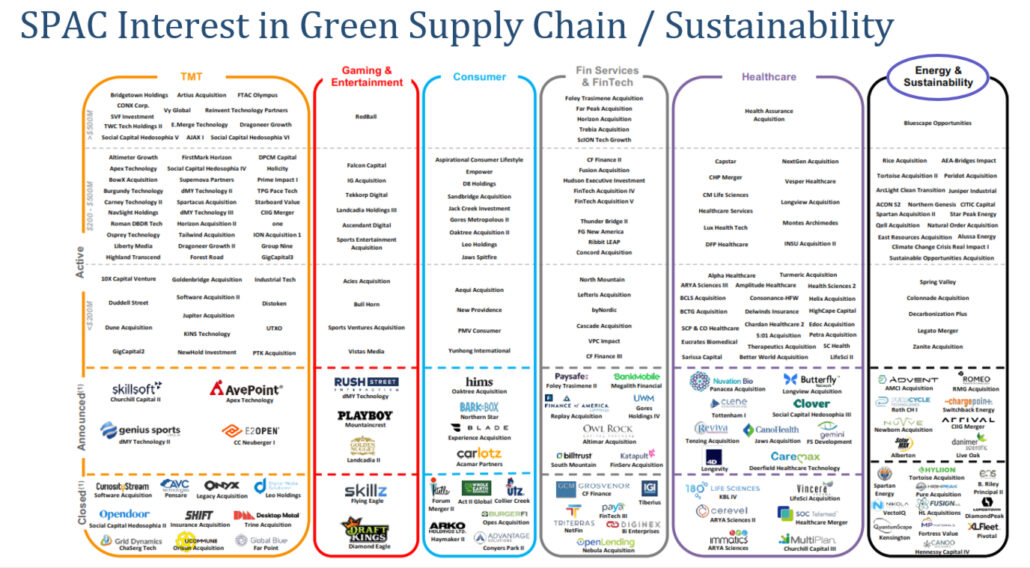

The capital markets are showing increased interest in supply chain. 74 SPACs were raised in 2020, featuring over $63 billion of dry powder. Many of them are looking at our sector. This includes EV companies like Hyliion and Canoo, as well as software companies. We expect to see more SPAC-supply chain activity in 2021.

Cambridge Capital Outlook

At Cambridge Capital, we have never been more excited about the outlook for high-growth supply chain/technology companies. The key themes we see continue to grow in importance.

Cambridge has put its money where its mouth is. In the past year, Cambridge has invested in

- Bringg – a SaaS-based last mile delivery orchestration platform, powering the world’s leading brands

- Liftit – an e-commerce leader automating last-mile transportation in Latin America

- GreenScreens.ai – predictive pricing and data analytics for logistics professionals

In addition, Cambridge has expanded its team. Today, the firm consists of eight professionals focused on helping supply chain companies to scale up.

In the coming year, Cambridge expects to back more outstanding companies and entrepreneurs. Please reach out to any of us if you have ideas for companies that fit our themes and would benefit from our capital, people and resources.

Perspective at BGSA

On the advisory side, BGSA continues to expand its M&A services. BGSA has earned a reputation as a leader in M&A for transportation, logistics, and supply chain services, and has worked on over 50 transactions in the sector. Clients and transactions have included NFI, C.R. England, GENCO (now FedEx), New Breed (now XPO), and many others.

BGSA continues to play an active role as trusted advisor to major companies in the sector. Just this week, BGSA’s client Werner Enterprises announced the sale of Werner Global Logistics to Scan Global Logistics Group. Please reach out to BGSA if you’d like to discuss deal ideas.

Closing Thoughts

In sum, we thank you for being a part of the BGSA Supply Chain ecosystem. We all learn and benefit from the collective wisdom of this outstanding network of CEOs and industry leaders.

To see highlights from 2021’s event, feel free to click here.

Please save the date for next year’s BGSA Supply Chain Conference: January 19-21, 2022. Next year we plan to return to the Breakers in Palm Beach, for our 16th annual conference!

Meanwhile, we look forward to a successful 2021 for our clients, to a busy year of strategic advisory work with BGSA Holdings, and to a few more outstanding platform investments with Cambridge Capital. If you would like to discuss strategic, financial, or other ideas, please feel free to contact me directly at (561) 932-1601 or Ben@BGSA.com.

Thank you and best wishes for the coming year.

Sincerely,

Benjamin Gordon