BGSA Supply Chain Conference 2023 Recap

On behalf of all of us at BGSA Holdings and Cambridge Capital, we wanted to share some highlights of BGSA Supply Chain 2023. For those of you who joined us, we hope you had a great time.

For our 17th annual Supply Chain conference, we returned as always to the Breakers in Palm Beach. Amidst the sunshine and palm trees, we were able to join with over 350 CEOs and leaders across all areas of the supply chain sector.

This record turnout included CEOs from North America, South America, Europe, Asia and Africa. We got to exchange ideas with leaders in logistics, distribution, freight forwarding, truck brokerage, warehousing, trucking, shipping, last mile, fulfillment, and other areas. As technology has become more and more embedded in the supply chain, we met with software all-stars in WMS, TMS, reverse logistics, predictive pricing, digital brokerage, and a host of ecommerce logistics categories. And we got to talk with legends including Apple CEO John Sculley, boxing champion Mike Tyson, Wimbledon winner John Lloyd, and many more. This was truly a “Davos for Logistics” week!

A Representative List of Industry Speakers and Leaders

For those of you who were not able to attend this year, we wanted to summarize what you missed.

2022 was the year the supply chain broke the world. Even the New Yorker joined in the action:

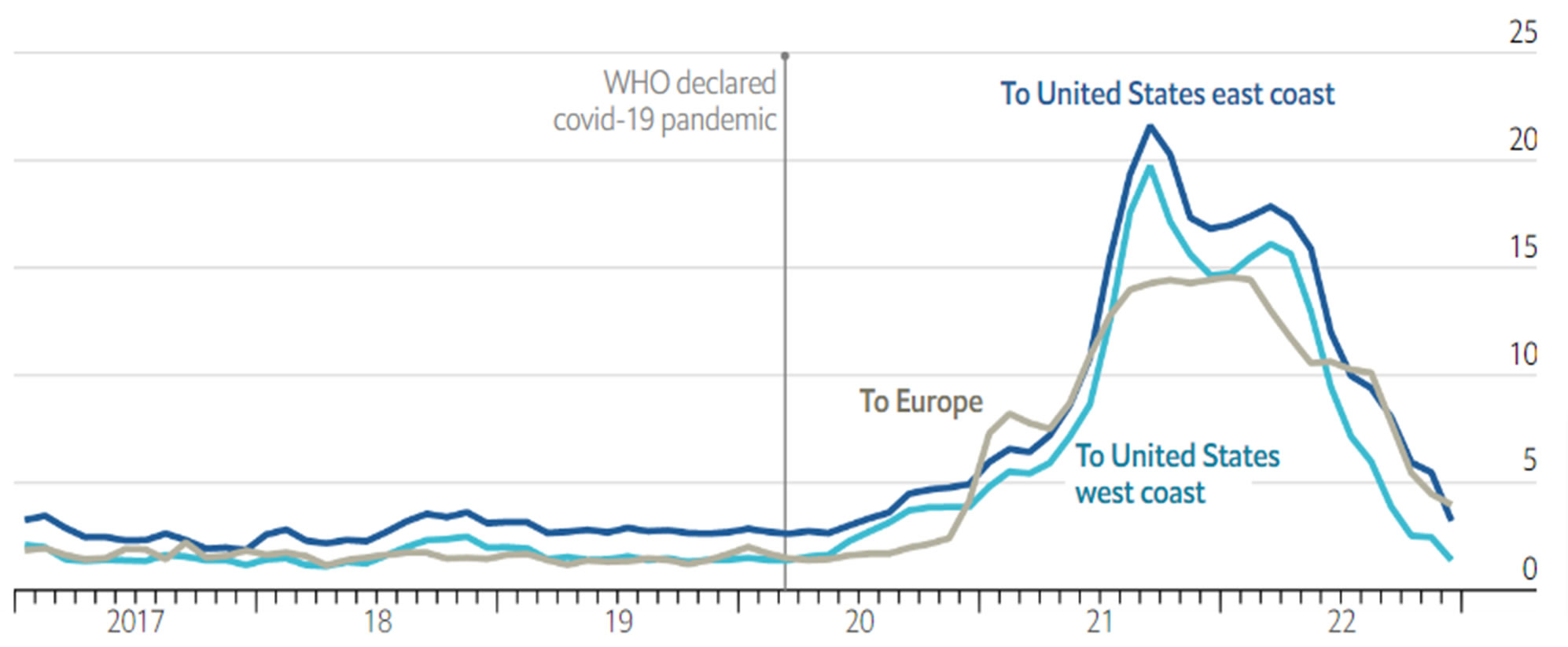

From a distance, the supply chain markets appeared to spiral out of control in 2021, driven by shortages, delays, and bottlenecks. In 2022, these challenges appeared to retreat, as we saw a return to normalcy in many categories. For instance, global shipping rates, which shot up over 7x in some categories, retrenched to pre-COVID levels.

Table 1: Shipping Container Costs from China, $K per 40-Foot Container

Source: Freightos

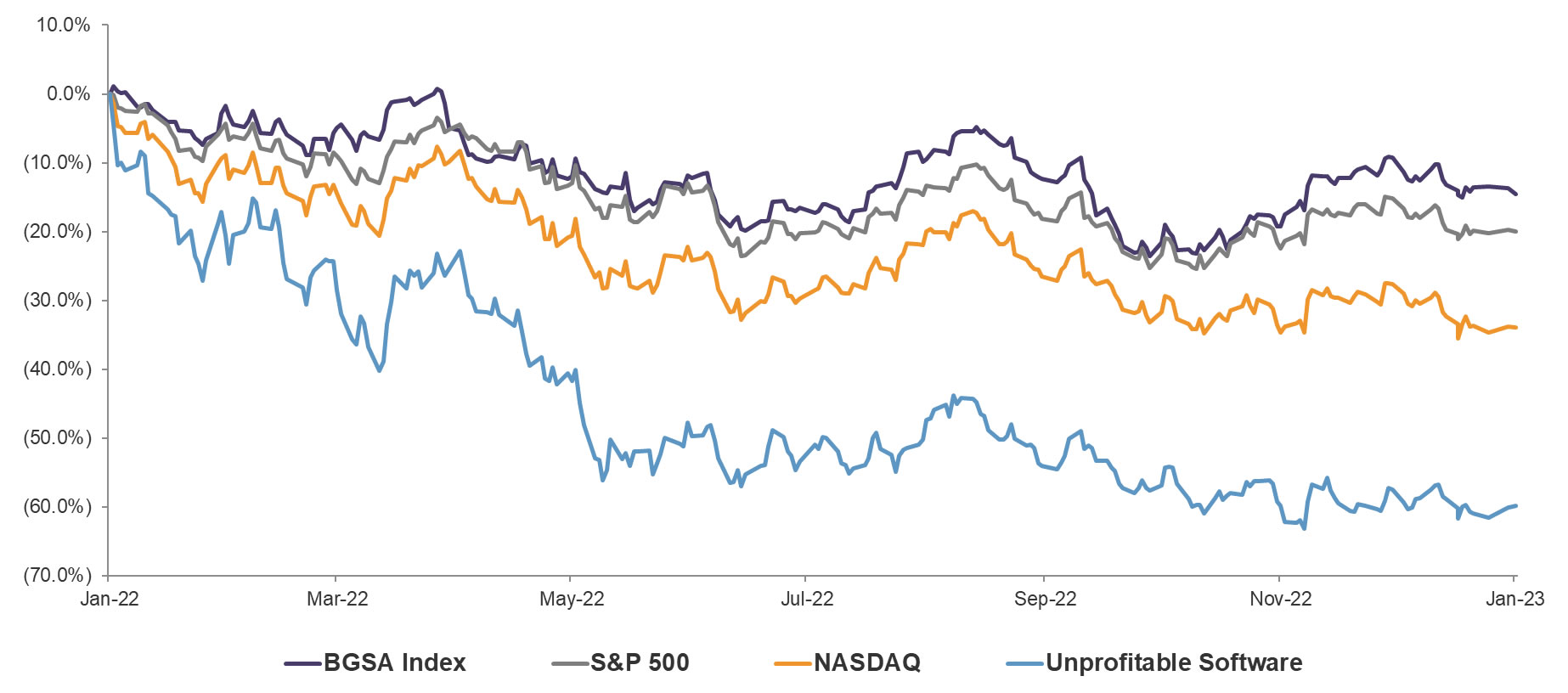

This “reversion to the mean” should have been good news for the economy, as it provided predictability to shippers, carriers, and logistics providers. Yet the reality was the exact opposite. The S&P dropped 20%, the NASDAQ fell 34%, and the basket of unprofitable software companies (a public proxy for private venture capital) fell 60%. By comparison, the BGSA Supply Chain Index fared relatively well, losing just 15%.

Table 2: 2022 Public Markets Performance

Source: Capital IQ, BGSA

What explains this divergence between supply chain resilience and public markets chaos?

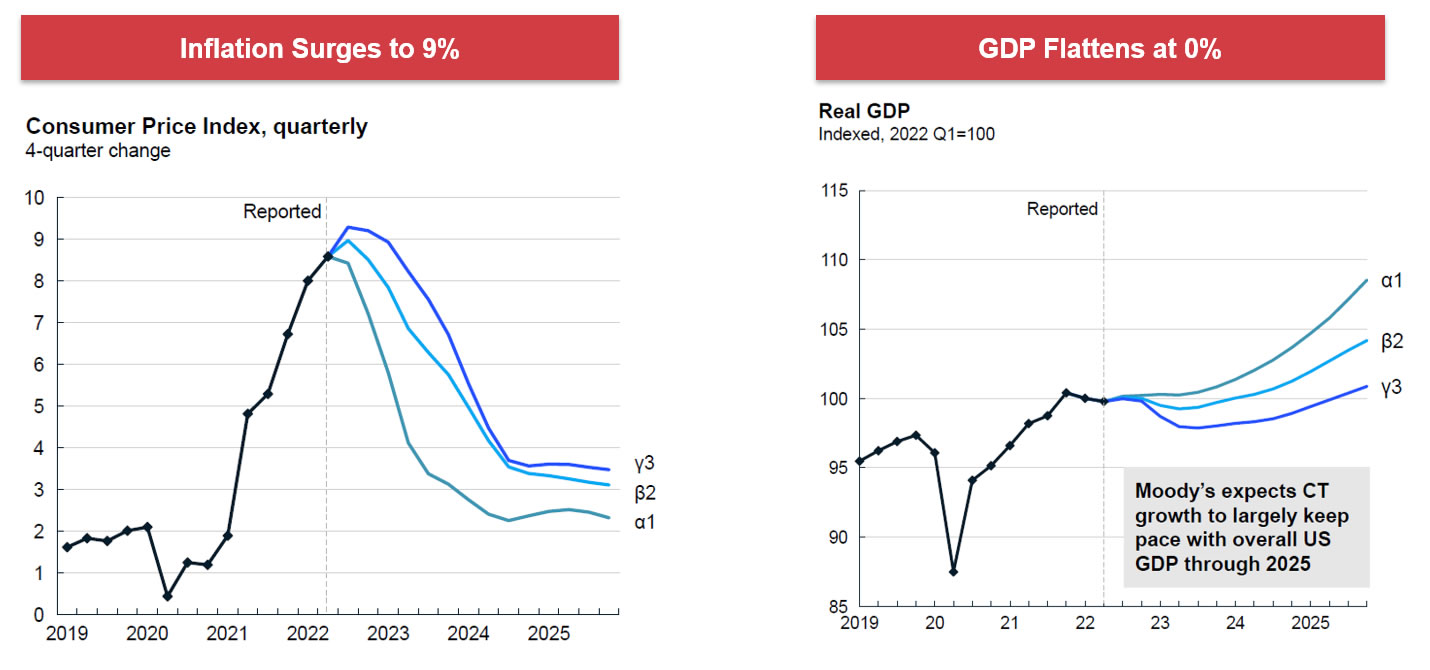

For starters, the macroeconomic environment worsened. We saw inflation spike to 9%, while GDP flattened at nearly 0%.

Table 3: Inflation and Recession Converge

Source: National statistics agencies, McKinsey analysis, Oxford Economics

These macroeconomic forces hit everyone. There was nowhere to hide.

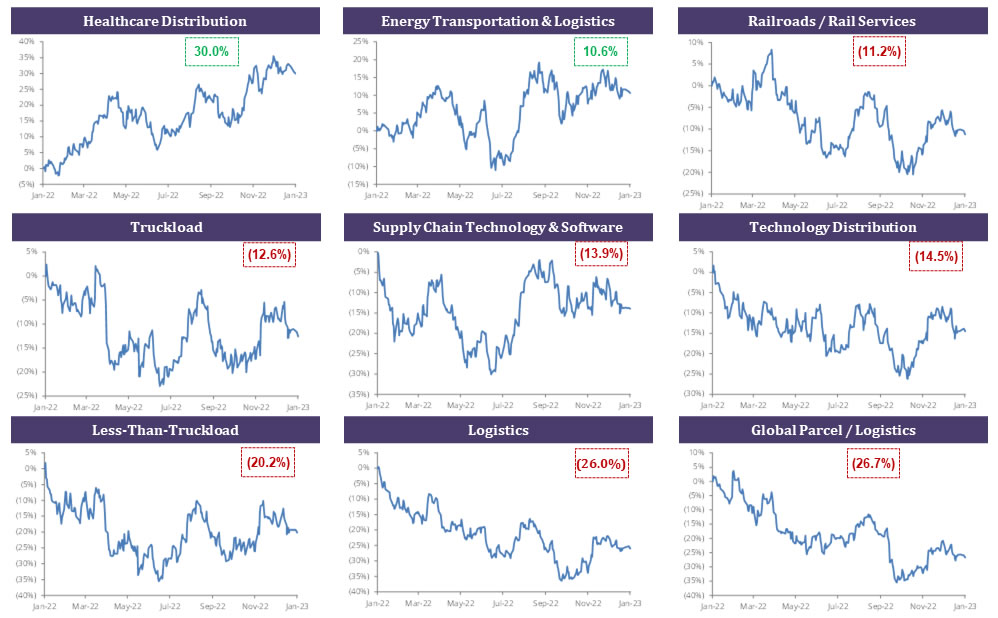

And when we take a closer look at the supply chain sectors, we can see this in more detail.

At BGSA, we track the BGSA Supply Chain Index, which is a basket of 68 companies across nine segments, including logistics, trucking, rail, supply chain technology, and all other related segments. In aggregate, the Supply Chain Index decreased 15% in 2022. In addition, aside from healthcare distribution and energy logistics, all other categories plummeted. The steepest drop, global parcel/logistics, fell 27%, as the ecommerce COVID surge of 2020-2021 cooled off, and companies like UPS, FedEx and DHL retrenched.

Table 4: 2022 BGSA Supply Chain Index: Everything Declined Aside from Healthcare and Energy Supply Chains

Source: Capital IQ, BGSA

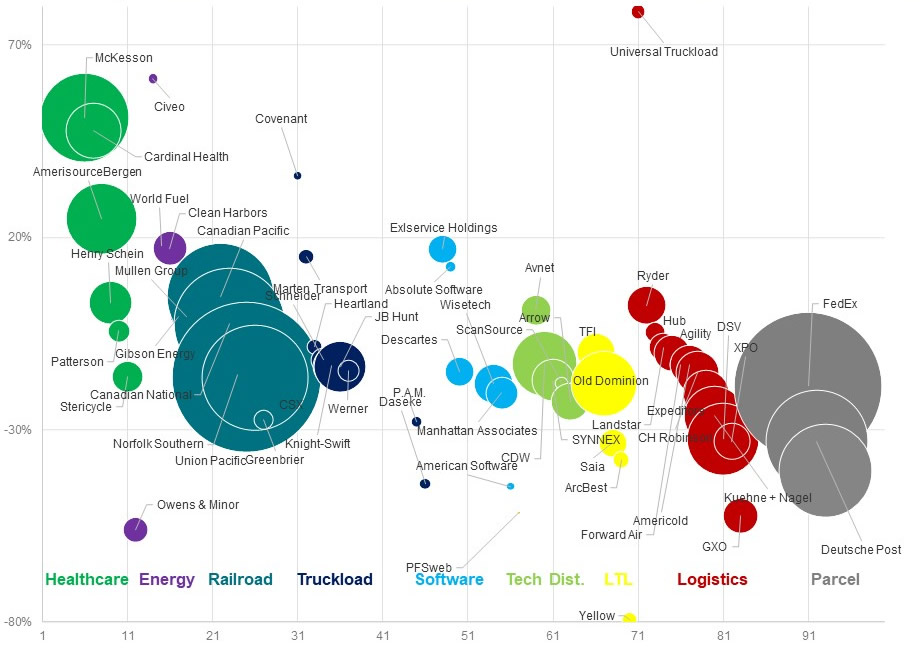

For most companies, 2022 was a difficult year, at least from a valuation standpoint. Aside from a few outliers, most of the 68 companies in the Supply Chain Index were hit.

Table 5: Market Value Change in 2022 for the BGSA Supply Chain Index

Source: Capital IQ, BGSA

So how do we make sense of 2022, and what is our outlook for the supply chain sector in 2023? In sum, we see four key issues:- Supply chain recession

- China: the great decoupling

- Tech: baby and bathwater

- Capital Markets: carpe diem

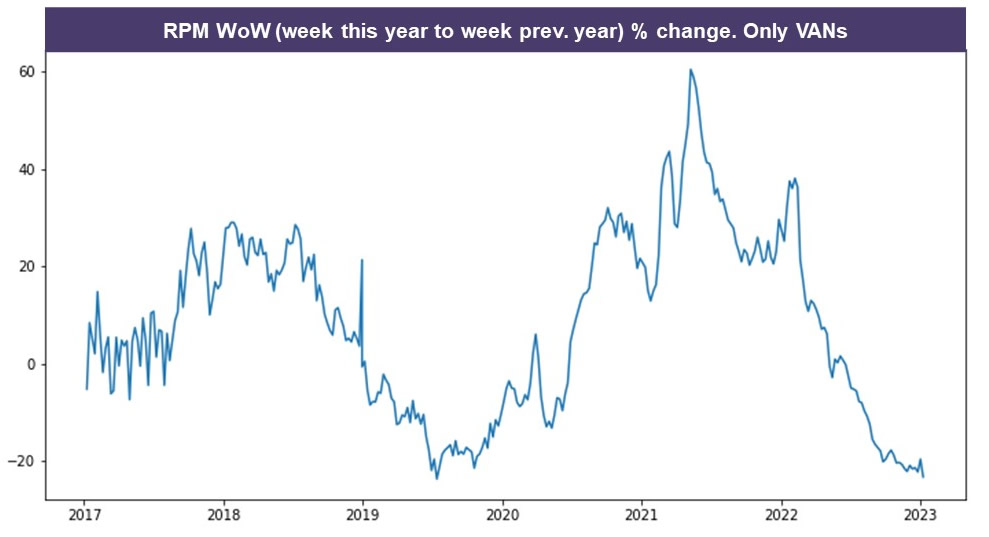

First, we are in midst of a supply chain recession. Truckload, LTL, ocean, rail – in nearly all categories, freight rates have dropped. In the largest segment, truckload, which represents close to $400 billion, we've witnessed the steepest decline in rates in the last 5 years.

Table 6: Record Decline in Truckload Rates

Source: GreenScreens.ai

Second, we are at the beginning of a US-China decoupling that will reshape global supply chains. For 50 years, dating back to President Nixon's visit to China in 1972, the US engaged in a strategy of economic diplomacy. The US encouraged commercial ties, in the hopes of achieving a geopolitical realignment. The US-China economic partnership was a way to build financial gain while also dividing the USSR from its communist allies. In some respects, the strategy worked. But in other respects, it created a dangerous dependency on China. For instance, the US now relies on China for 80% of its rare earths elements. Other concerns include imbalanced trade, risk of intellectual property theft, and disruptions fueled by government policy. As a result, companies are increasingly shifting their supply chains.

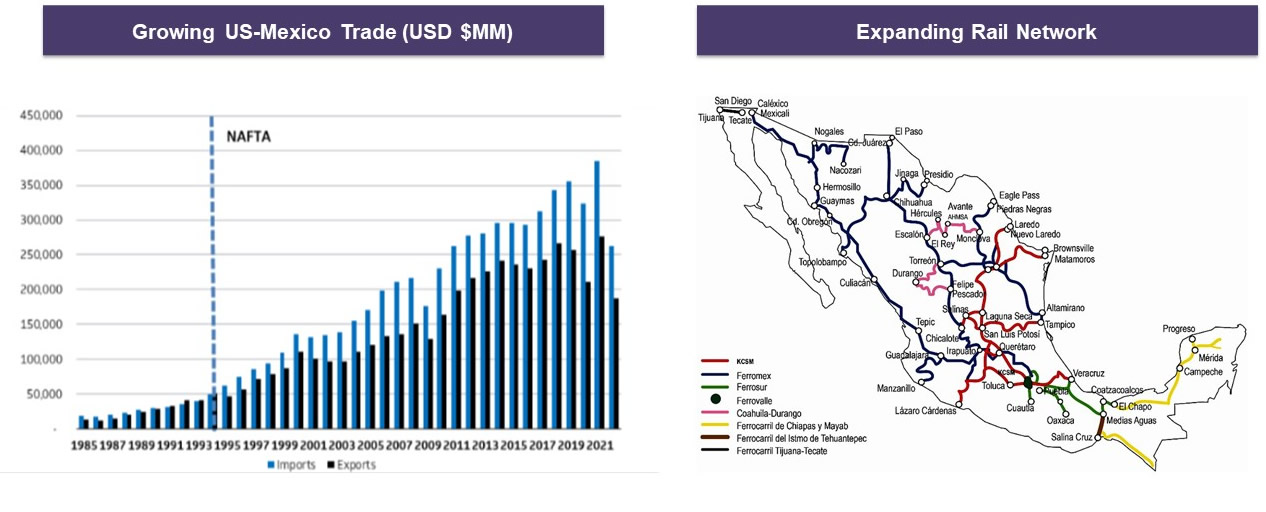

China's loss is Mexico's gain. Manufacturers are moving plants to India, South Korea, Japan, and Europe. But nowhere is the shift more likely than Mexico. We expect to see a continuation of US-Mexico trade, and a buildout of the US-Mexico rail network, as goods manufactured in Mexico can make it to Chicago in less than half the time of China.

Table 7: Supply Chain Shifts from China to Mexico

Sources: US Census Bureau, Cowen, Anuario Estadistico Comunicaciones y Transportes

Third, we are witnessing a massive increase in supply chain technology investment.

Skeptics may point to overfunded companies with no moat. For instance, investors funneled billions of dollars into the 15-minute grocery delivery segment. Two of those companies, Gorillas and Getir, announced layoffs and then merged with one another.

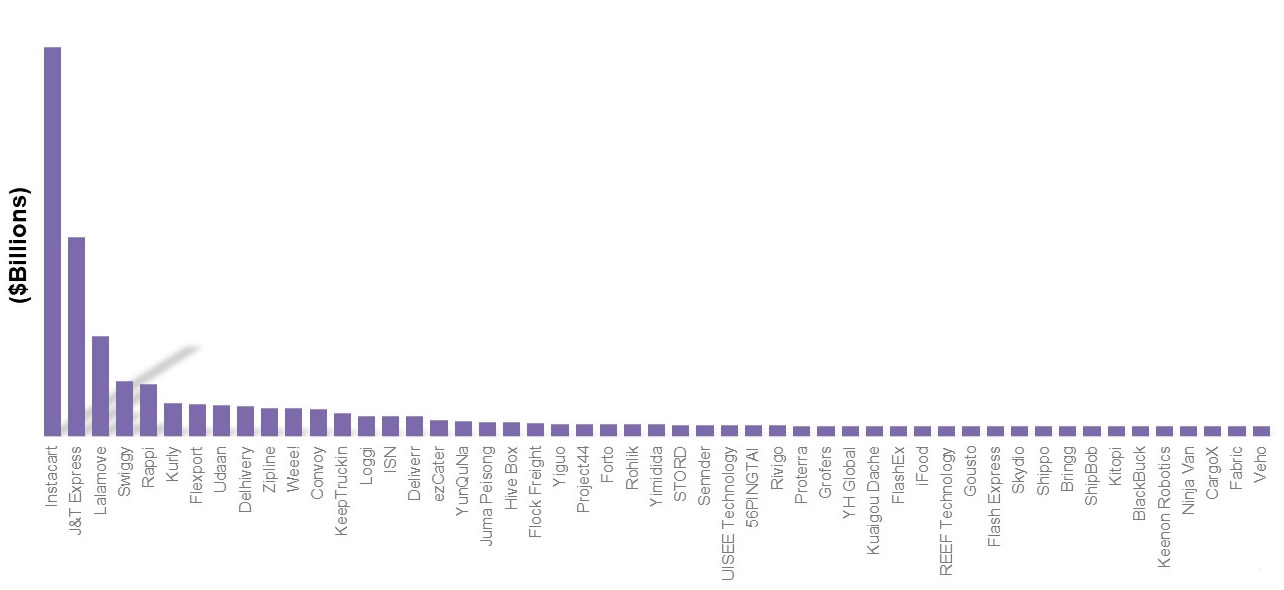

Yet the real story lies not in the failures, but in the successes. In the last 2 years, investors have committed over $100 billion in the supply chain sector. This capital has accelerated the growth of many outstanding companies. And we believe the innovation is still in the early innings.

Table 8: The Supply Chain has Minted 51 Unicorns

Source: WSJ / Pitchbook

Fourth, the capital markets reflect that the deal environment remains active. In 2022, we saw a wave of M&A and investment activity. We believe these deals can be classified in five categories.- Consolidators looked to buy up competitors. For instance, Lineage Logistics bought Versacold to consolidate its leadership in the cold storage warehousing arena

- Logistics companies pursued deals to expand their services. STG Logistics bought XPO Intermodal to expand its port-based capabilities in intermodal.

- Ecommerce companies sought to move into logistics. Cart.com acquired FB Flurry to build its fulfillment network.

- Cross-Border expansion. Schenker made a major move in US transportation with the acquisition of USA Truck.

- Investors doubling down on winners. Tiger Global made its second investment in less than a year in GreenScreens.ai, which expanded over 500% in the past year.

Going forward, what do we expect to see in 2023?

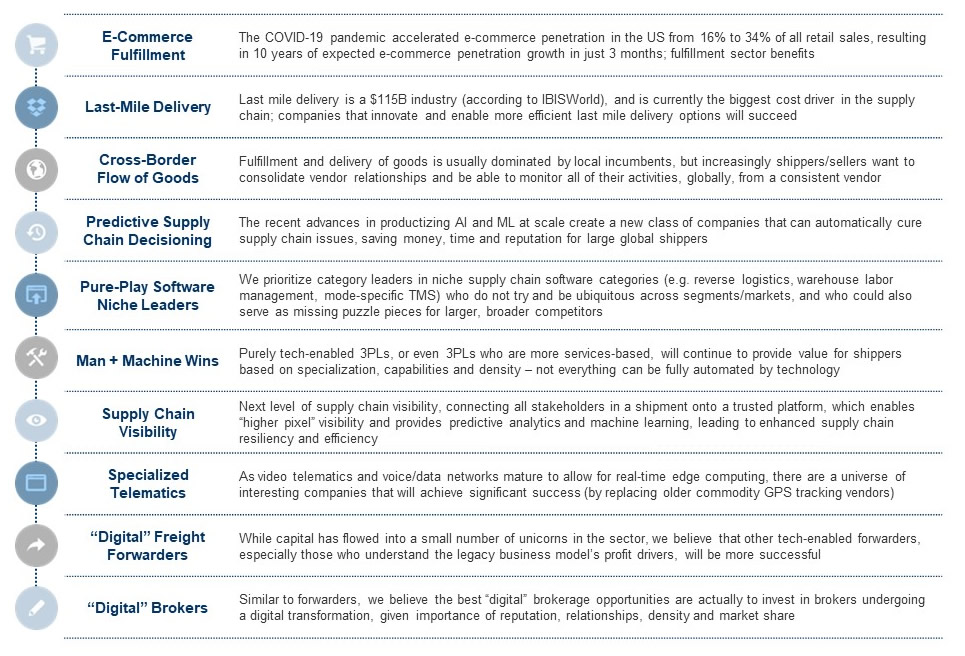

At Cambridge Capital, we believe we are in the early innings of a transformation in high-growth digital supply chains. Some of the key themes we see include last-mile logistics, AI to automate supply chains, supply chain visibility, reverse logistics, and tech-enabled "man + machine" services. To illustrate these ideas, please see below. At Cambridge, we believe in putting our money where our mouth is. We have made a series of investment in companies in these arenas. They include the following:

- Bringg: for the B2C supply chain, last-mile delivery comprises 41% of total costs. In last-mile logistics SaaS, we believe Bringg is emerging as the market leader. We have backed them since 2016, have watched them scale up from a startup to the incumbent, and are pleased to welcome Insight Partners and others in backing one of the latest unicorns in logistics.

- ReverseLogix: as ecommerce increases, returns are shooting upward, since 30% of online purchases are returned. The reverse logistics market suffers from manual processes, a lack of visibility into returns data and metrics, and a poor customer experience. We believe ReverseLogix has built the first true end-to-end returns management system (RMS).

- Parcel Perform: ecommerce growth is also driving demand for supply chain visibility. Founded by DHL alumni, Parcel Perform understands the market gap in visibility, and is giving consumer brands and marketplaces a powerful tracking solution. We are proud to back them, along with Softbank.

- Everest: as freight markets continue to exhibit volatility, shippers need reliable and high-quality freight management companies. The Everest team has built a tech-enabled truck brokerage and logistics solution that is growing rapidly with blue-chip CPG companies.

- Boa Logistics: medium-sized shippers, especially those with perishable goods, have long been plagued with high delivery costs and poor service levels. Boa Logistics is the largest dedicated temperature-controlled LTL platform in the country serving this niche. Boa is rapidly expanding nationwide on the back of a recapitalization by Cambridge in August 2022.

- byrd: Europe is a highly-fragmented market, especially for e-commerce fulfillment. byrd is the leading provider of software-based fulfillment services in 8 countries, and allows brands in the region to sell globally, but be serviced by a centralized tech-enabled partner that is accountable for results.

- Liftit: Another region with major fragmentation and opportunity is Latin America. Liftit built a tech-enabled trucking marketplace servicing B2B customers in Colombia, Mexico and Ecuador, finally bringing visibility, automation and optimization to large enterprise shippers in these countries.

- DeliveryCircle: On-demand deliveries for specialty/large products such as tires and other items have been overlooked by many market participants, and DeliveryCircle has built a strong niche business focusing on this lucrative sector.

- Greenscreens.ai: There has been much talk of AI in transportation – but little to show for it. Greenscreens.ai has built the first predictive pricing model for truckload freight that actually provides tangible value to customers. Greenscreens.ai has grown over 500% this year, with some of the strongest unit economics we have ever seen – evidence of true product-market fit.

Cambridge Capital Key Investment Themes

Cambridge Capital is currently seeking new investment opportunities, so please let us know if you would like to discuss how Cambridge may be a fit for your business. For more information, please feel free to contact me at Ben@CambridgeCapital.com.

Perspective at BGSA

On the advisory side, BGSA continues to expand its M&A services. BGSA has earned a reputation as a leader in M&A for transportation, logistics, and supply chain services, and has worked on over 50 transactions in the sector. Clients and transactions have included NFI, C.R. England, GENCO (now FedEx), New Breed (now XPO), and many others. BGSA continues to play an active role as trusted advisor to major companies in the sector. Just this week, BGSA's client Werner Enterprises announced the sale of Werner Global Logistics to Scan Global Logistics Group. Please reach out to BGSA if you'd like to discuss deal ideas. If you would like to discuss acquisitions, divestitures, or other deal ideas, please reach out to Shai Greenwald at Shai@BGSA.com.

Closing Thoughts

In sum, we thank you for being a part of the BGSA Supply Chain ecosystem. We all learn and benefit from the collective wisdom of this outstanding network of CEOs and industry leaders.

To see highlights from 2023's event, including photos of our amazing attendees, feel free to click here.

Please save the date for next year's BGSA Supply Chain Conference: January 24-26, 2024. Next year we will again return to the Breakers in Palm Beach, for our 18th annual conference!

Meanwhile, we look forward to a successful 2023 for our clients, to a busy year of strategic advisory work with BGSA Holdings, and to a few more outstanding platform investments with Cambridge Capital. If you would like to discuss strategic, financial, or other ideas, please feel free to contact me directly at (561) 932-1601 or Ben@CambridgeCapital.com.

Thank you and best wishes for the coming year.

Sincerely,

Benjamin Gordon