BGSA Supply Chain Conference 2024 Recap

On behalf of all of us at BGSA Holdings and Cambridge Capital, we wanted to share some highlights of BGSA Supply Chain 2024. For those of you who joined us, we hope you had a great time.

For our 18th annual Supply Chain conference, we returned as always to the Breakers in Palm Beach. Amidst the sunshine and palm trees, we were able to join with over 350 CEOs and leaders across all areas of the supply chain sector.

This record turnout included CEOs from North America, South America, Europe, Asia and Africa. We got to exchange ideas with leaders in logistics, distribution, freight forwarding, truck brokerage, warehousing, trucking, shipping, last mile, fulfillment, and other areas. As technology has become more and more embedded in the supply chain, we met with software all-stars in WMS, TMS, reverse logistics, predictive pricing, digital brokerage, and a host of ecommerce logistics categories. And we got to talk with over 30 of the top supply chain CEOs about their outlook for 2024. This was truly a “Davos for Logistics” week!

2024 Opening Remarks

A Representative List of Speakers and Industry Leaders

For those of you who were not able to attend this year, we wanted to summarize what you missed.

2023 was the year that proved gravity is undefeated. What went up during COVID came down thereafter. Freight rates, for instance, doubled from March 2020 to December 2021. But the air came out of the tires, as rates plunged 38% in the subsequent two years, returning to 2019 levels.

Table 1: Truckload Rates, 2013-2023

Source: Truckstop.com, Truckloadrate.com

The “COVID Hangover Effect” rippled through supply chains, causing freight rates to plummet, inventory replenishment cycles to slow down, and demand to soften. Meanwhile, overcapacity lurked over the industry, applying downward pressure on rates.

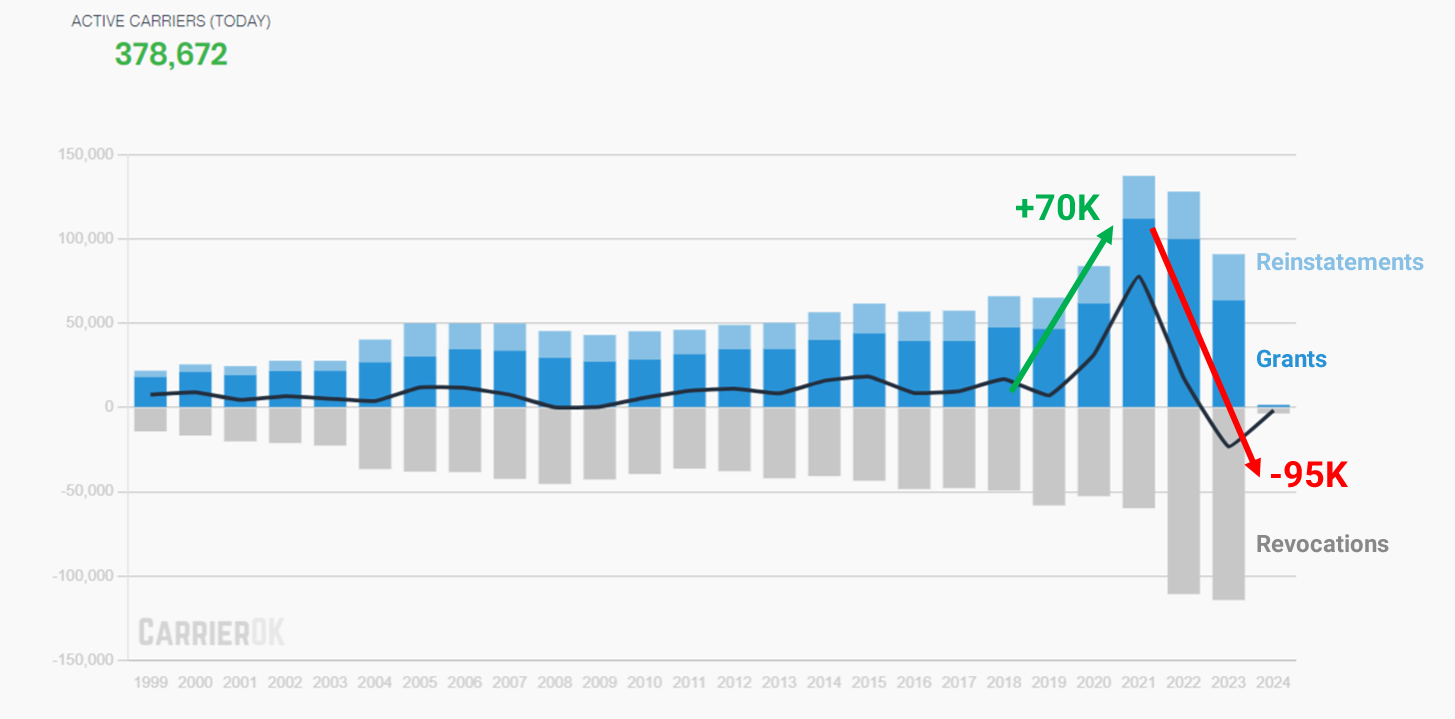

Table 2: Net Carrier Levels Drop 25%, to 379K

Source: Federal Motor Carrier Safety Administration

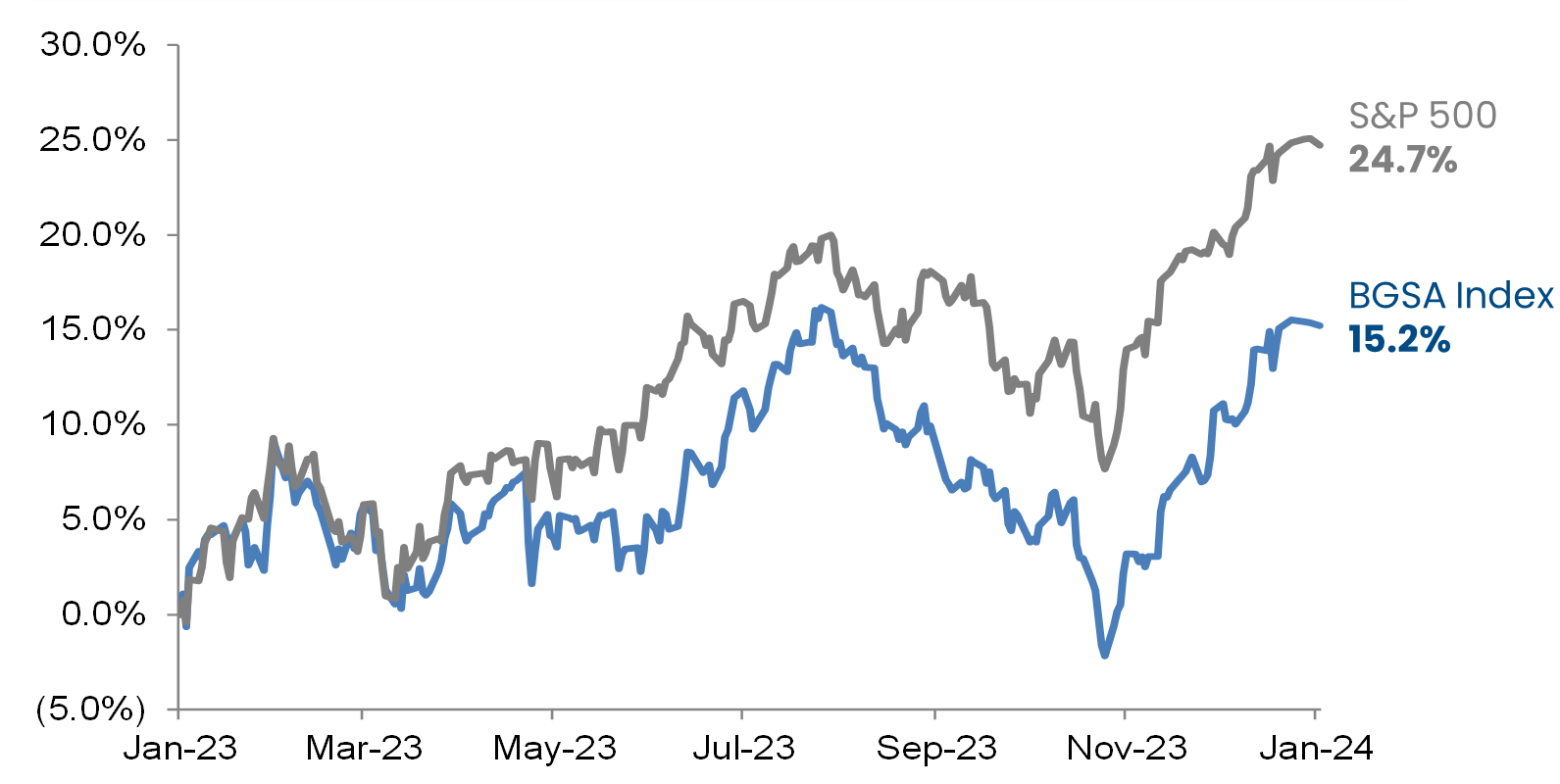

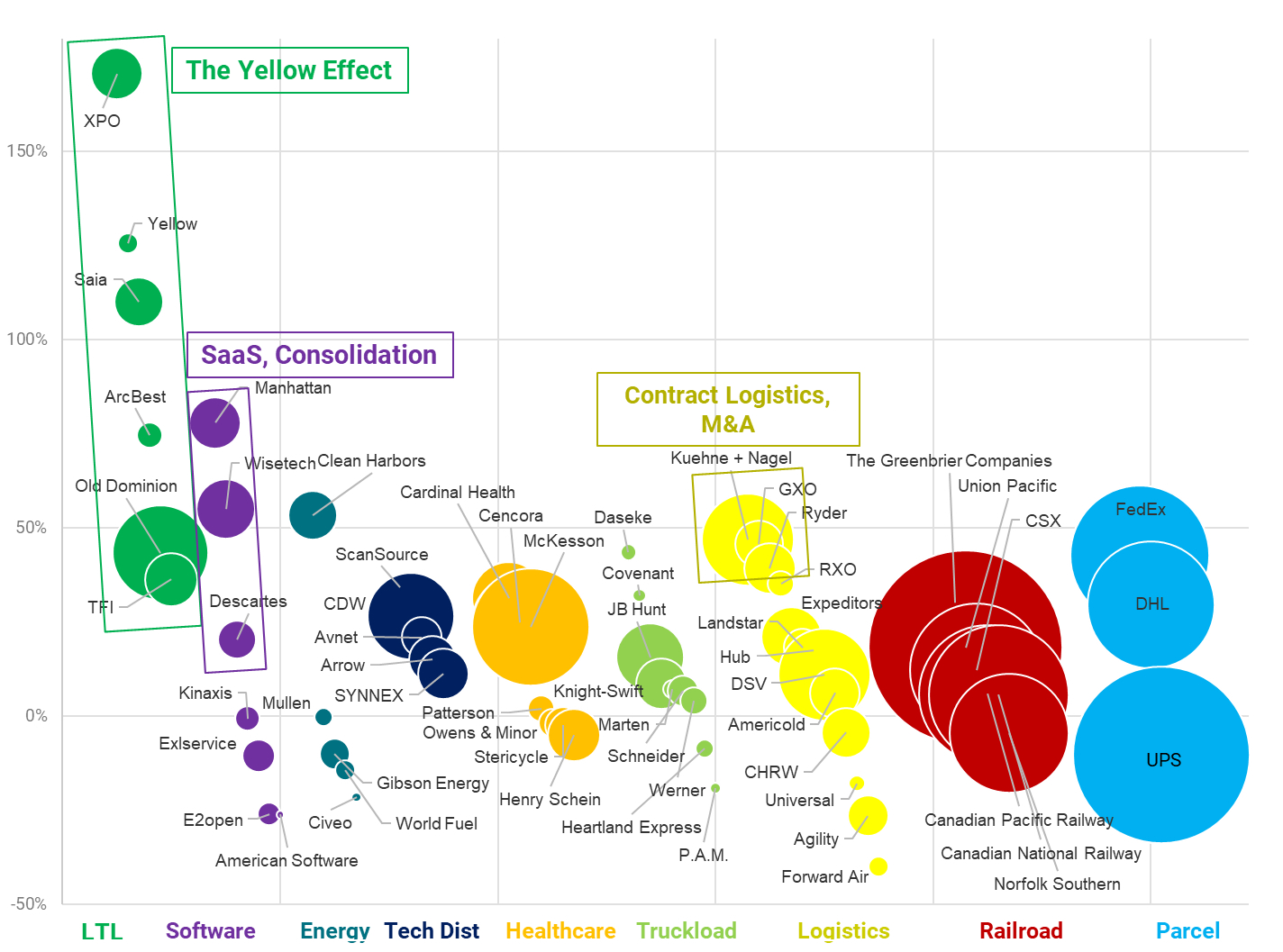

On average, the supply chain public markets underperformed the S&P 500.

At BGSA, we track the BGSA Supply Chain Index, which is a basket of 61 companies across nine segments, including logistics, trucking, rail, supply chain technology, and all other related segments. While the S&P 500 grew 24.7%, the BGSA Supply Chain Index only increased 15.2%.

Table 3: S&P 500 vs. BGSA Supply Chain Index

In 2023, we saw a major divergence between overperformers and underperformers. While the category as a whole generated a 15.2% annual return, the LTL sector dominated, with a 60.0% value increase led by XPO (171%). Supply chain software also generated strong results, with a 33.3% boost spearheaded by Manhattan Associates (78%) and WiseTech (55%). And three logistics companies (Kuehne & Nagel, GXO and Ryder) led the way in contract logistics, delivering 39-47% growth.

As we look at the public company data, we can see three themes emerge:

- LTL: Addition through Subtraction. The Yellow bankruptcy removed capacity from the market, boosted market pricing, and enabled other LTL carriers to gain revenue

- Software: Clouds Clear. The most successful public supply chain software companies achieved strong growth in Software-as-a-Service (e.g. 96% recurring revenue growth at WiseTech). In addition, they accelerated through acquisitions like WiseTech-Envase and Descartes-GroundCloud.

- Logistics: Greed is Good, but Bland is Better. In a volatile market, the top performers were contract logistics giants like K&N, GXO and Ryder, who delivered steady growth supported by predictable long-term contracts, and boosted by acquisitions like K&N-Farrow, GXO-PFSweb and Ryder-Impact.

Table 4: 2023 Stock Market Performance of BGSA Supply Chain Index, by Company

Source: Capital IQ, BGSA

So how do we make sense of 2023, and what is our outlook for the supply chain sector in 2024?

In sum, we see four key issues:

- Supply chain recession: gravity wins

- Globalization and its discontents: the resurgence of nearshoring

- Tech: less is more

- Capital Markets: carpe diem

First, we have just witnessed the deepest supply chain recession since deregulation. But is it really a recession, or the return of gravity? Over the last 3 decades, logistics as a category grew by over 15% annually. Many believed it was impervious to cycles. The last five years have conclusively shown otherwise.

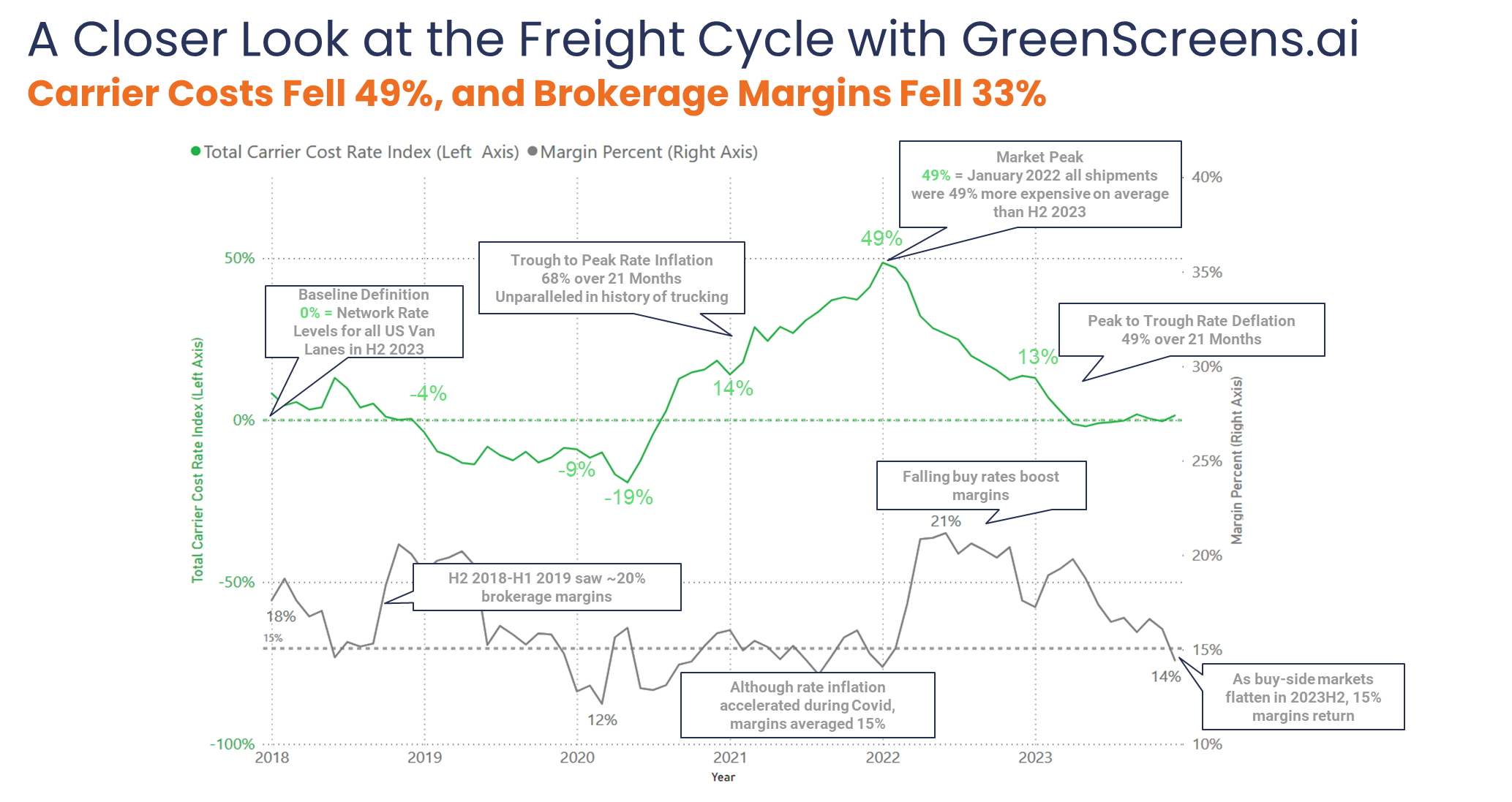

Truckload freight illustrates this gravitational force. Cambridge Capital’s portfolio company Greenscreens.ai has built a valuable database of market data that showcases the last 5 years’ trends in truckload pricing. Table 5 highlights that during COVID, carrier rates spiked 84%. But after peaking in January 2022, these rates plummeted down 49%, returning to 2018 levels. Meanwhile, during COVID, brokerage margins surged 75% on a percentage basis (and even more on a dollar basis, given volume increases). From their peak of 21%, brokerage margins have since fallen to 14%, approaching the post-recession lows in Q1 2020.

The good news is that, while gravity wins, we seem to have hit bottom, as rates stabilized in H2 2023, and appear to be starting to resume growth.

Table 5: Post-COVID, Truckload Prices Dropped 49%, and Truck Brokerage Margins Fell 33%

Note: Data represented in the ‘Total Carrier Cost Rate Index” reflects dry van price trends using most recent 6-months (2023H2) of buy-side rate data as a baseline to apply to all shipments from 2018 to 2023. Margins Percent reflects the difference between Buy-Sell prices in aggregate percentages over the same period.

Source: Greenscreens.ai

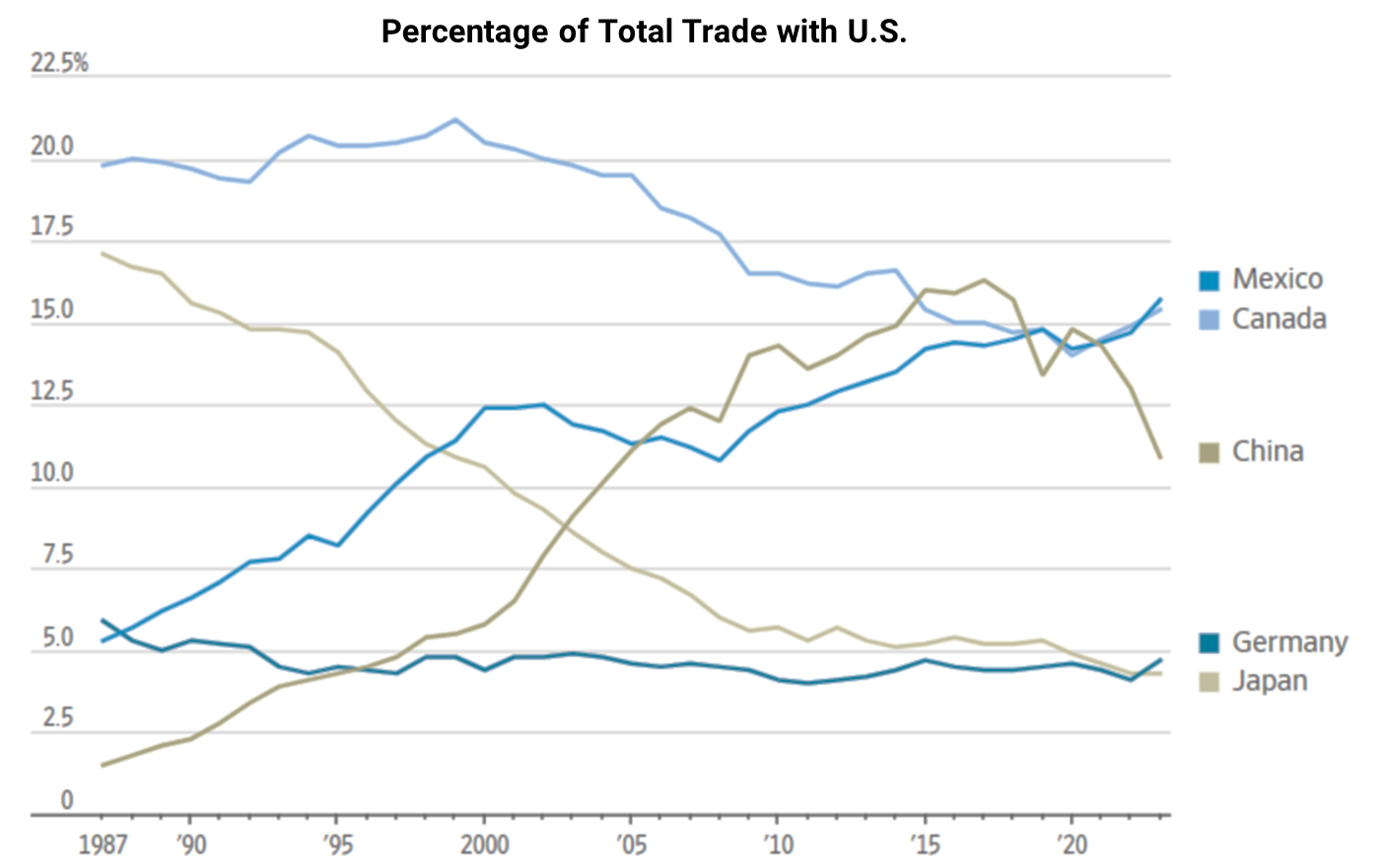

Second, we are witnessing the continuation of a shift in US global trade partners. This past year, Mexico surpassed China and Canada to become America’s #1 trading partner. As Fortune 500 companies increase their investment in US and Mexico-based manufacturing facilities, we are seeing an increase in supply chain spending associated with nearshoring.

Table 6: Mexico Overtakes China as America’s #1 Trading Partner

Source: Census Bureau, WSJ

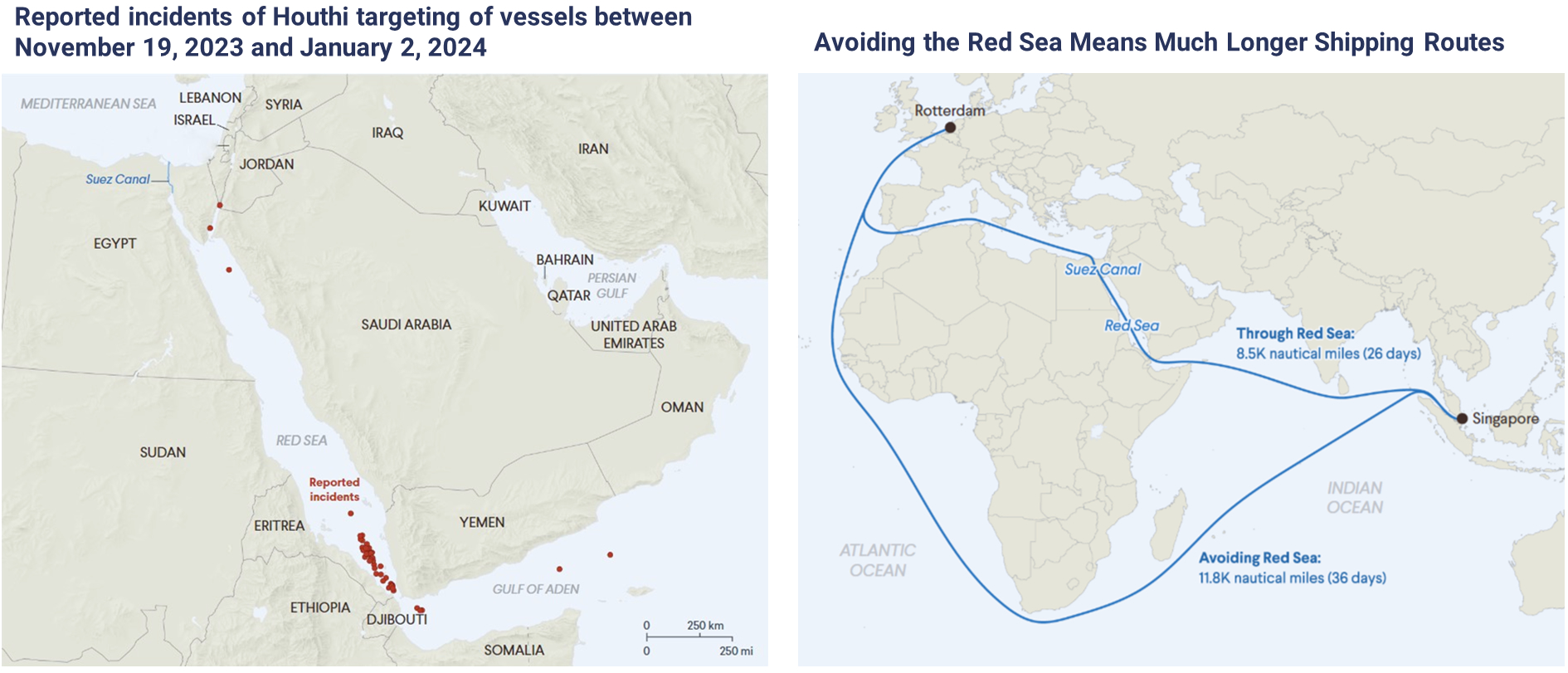

Meanwhile, global threats continue to increase. The Iran-sponsored Houthis have attacked ships in the Red Sea 26 times since November 19th, 2023. The terror attacks are designed to block companies from doing business with Israel and with Egypt, as shippers using the Suez Canal rely on Red Sea passage to reach Asia. 30% of all global container trade passes through the Suez Canal. Will these Houthi drone and missile attacks drive up shipping inflation, and also accelerate nearshoring?

Table 7: Houthi Terror Attacks on Red Sea Shipping Disrupts 30% of all Container Traffic

Source: CFR, Reuters, Ambrey Analytics

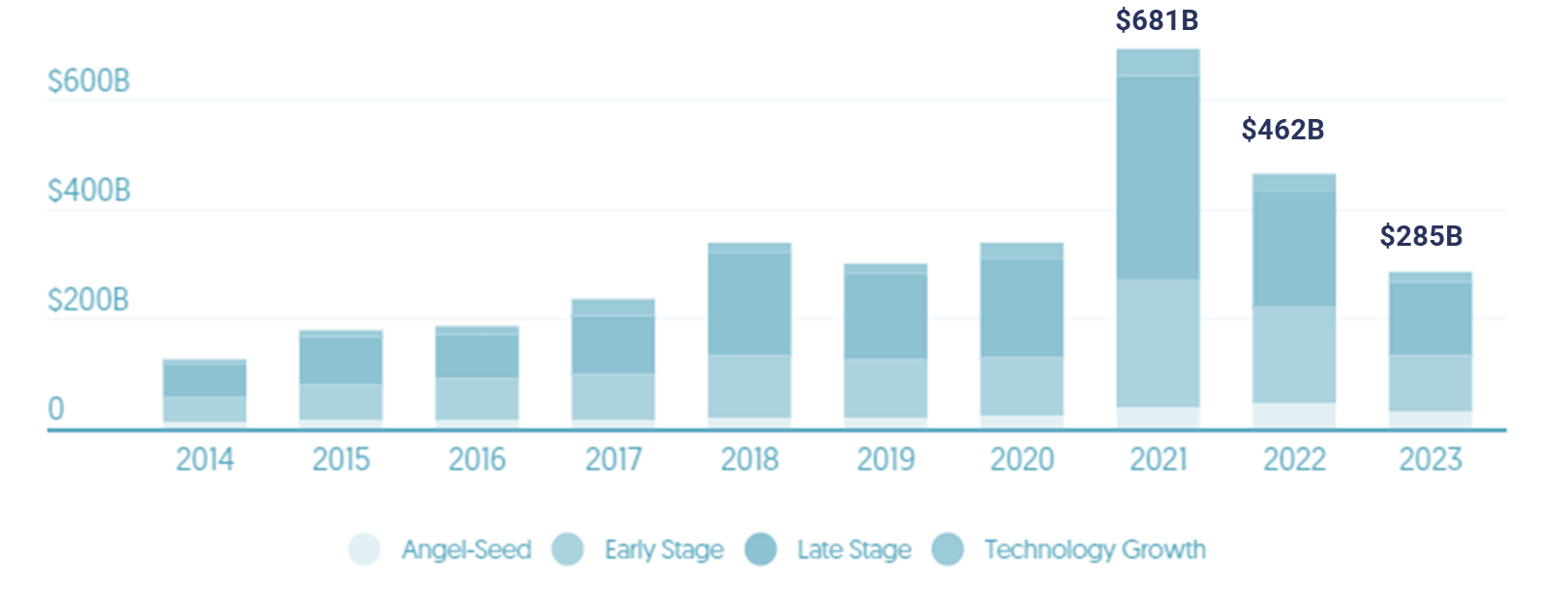

Third, technology funding has hit a 5-year low. After nearly doubling to $681B in 2021, tech investment has dropped to $285B. The decline has hit all stages of funding. As a result, startups have become more likely to seek alternatives, including M&A exits.

Table 8: Decline in Technology Investment

Source: Crunchbase

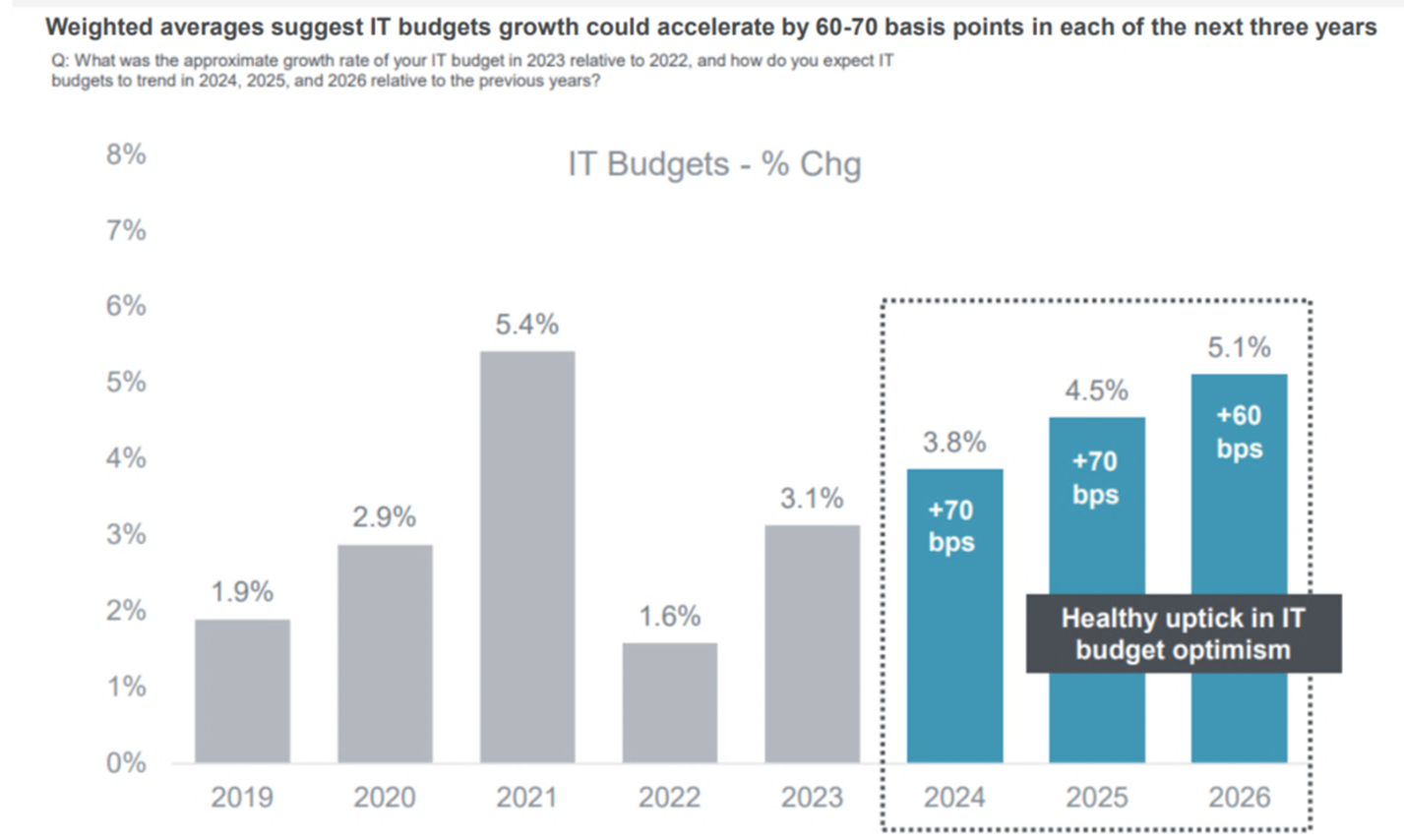

On the other hand, technology spending is expected to increase. A survey of corporate IT executives suggests that after a soft 2022, companies expect to increase their technology budgets by 3.8 to 5.1% in the next 3 years.

Table 9: Increase in IT Budgets

Sources: FactSet, Piper Sandler

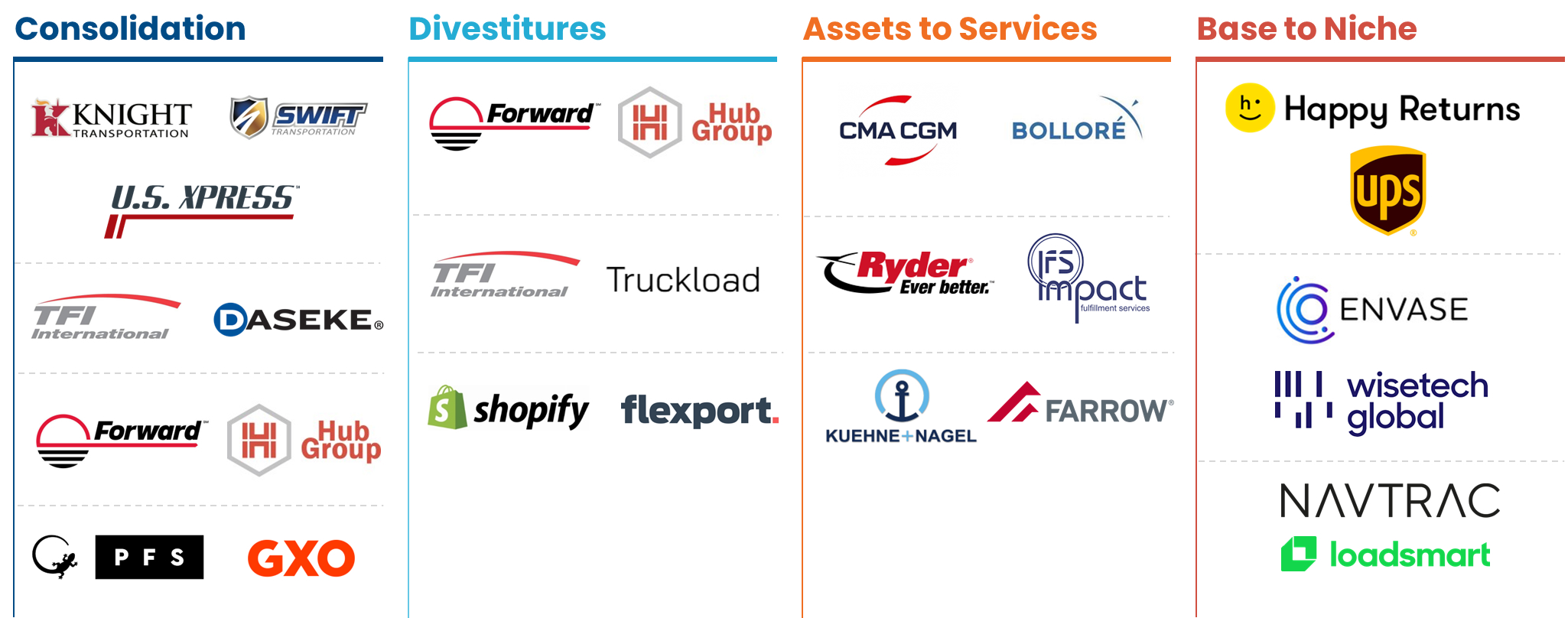

Fourth, the capital markets suggest that 2024 is a time to seize the day. While many companies hunkered down in 2023 to withstand the freight recession, a few aggressive buyers took advantage of the opportunity to pursue growth. Four key themes emerged:

- Consolidation: companies like Knight-Swift, TFI, Hub and GXO bought out competitors

- Divestitures: firms like Forward Air and Shopify divested non-core divisions to simplify and focus

- Assets to services: asset-based giants like CMA CGM and Ryder pursued asset-light acquisitions to grow, diversify, and reduce asset intensity

- Base to niche: businesses like UPS, WiseTech, and Loadsmart acquired niche specialists to expand their scope of solutions

And indeed, some of those acquisitions came together here at our BGSA Supply Chain conference!

Table 10: M&A Trends in Supply Chain

Source: BGSA Analysis

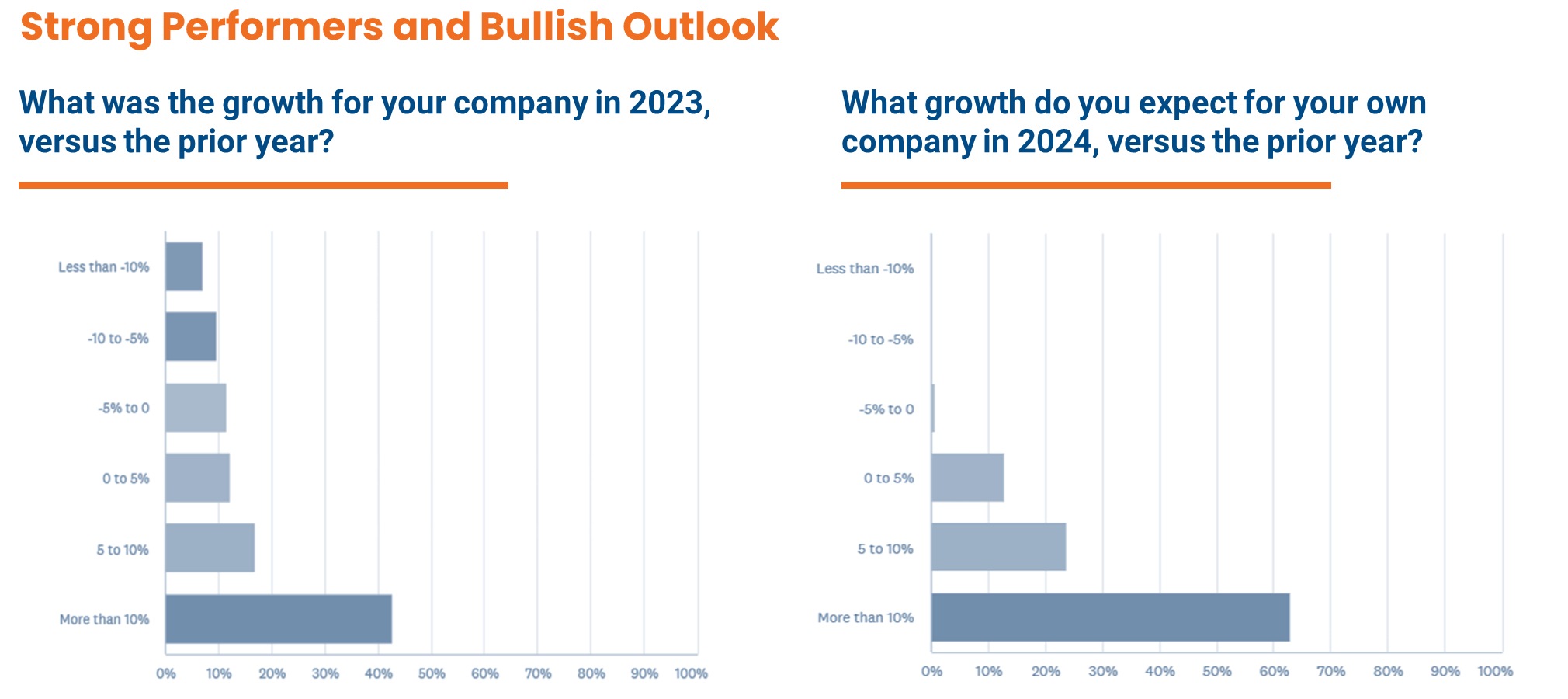

Lastly, what is the sentiment for the coming year? The feedback from the CEOs and leaders who joined us at BGSA Supply Chain was quite positive. As the below table shows, over 60% expect to see double-digit growth this year. This is an encouraging sign for the market as a whole.

Table 11: Outlook for 2024 based on BGSA Supply Chain Attendees

Source: BGSA Supply Chain Conference Survey

Going forward, what do we expect to see in 2024?

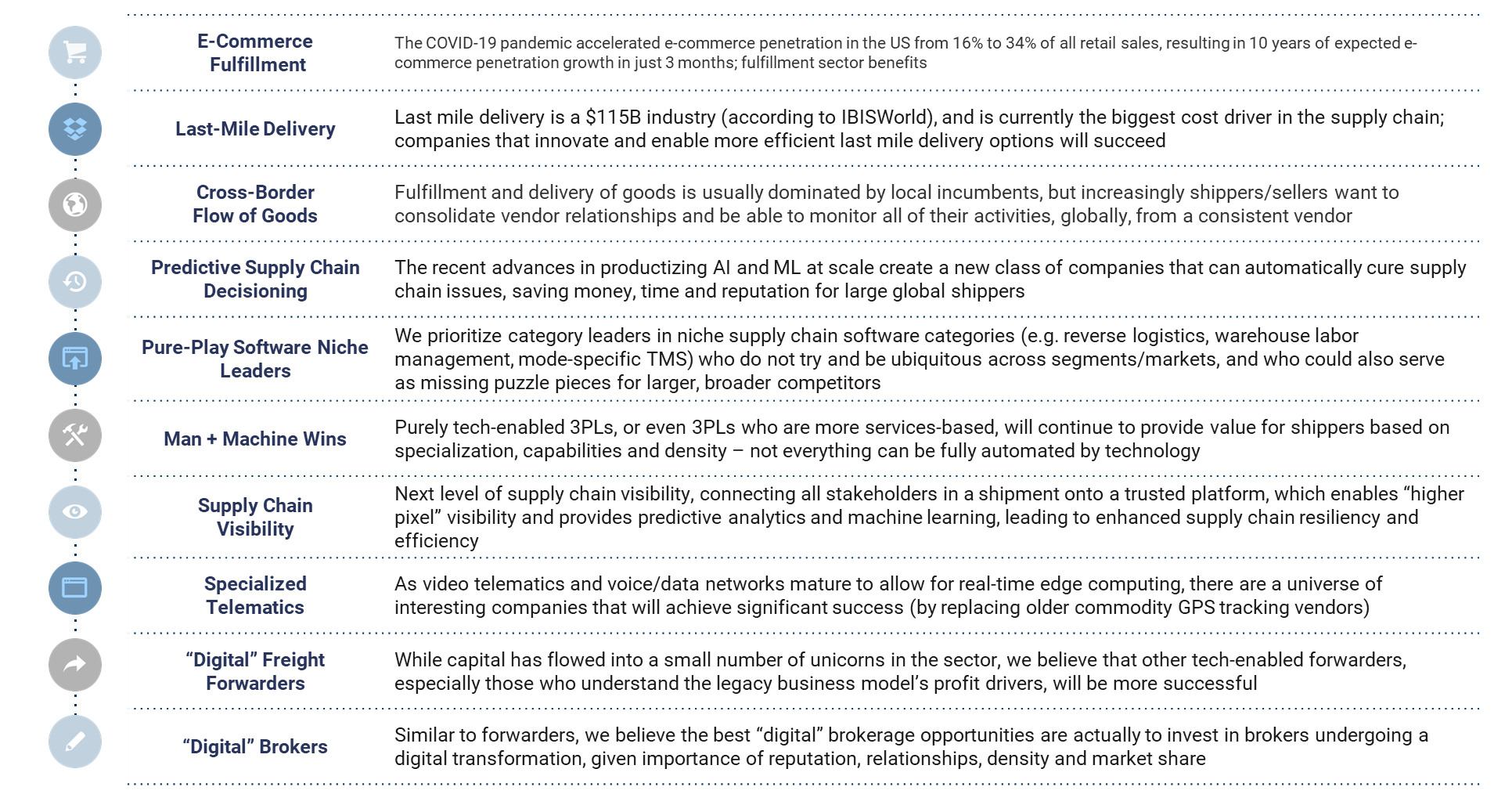

At Cambridge Capital, we believe we are in the early innings of a transformation in high-growth digital supply chains. Some of the key themes we see include last-mile logistics, AI to automate supply chains, supply chain visibility, reverse logistics, and tech-enabled “man + machine” services. To illustrate these ideas, please see below.

Cambridge Capital Key Investment Themes

At Cambridge, we believe in putting our money where our mouth is. We have made a series of investments in companies in these arenas. They include the following:

- Bringg: for the B2C supply chain, last-mile delivery comprises 41% of total costs. In last-mile logistics SaaS, we believe Bringg is emerging as the market leader. We have backed them since 2016, have watched them scale up from a startup to the incumbent, and welcome Insight Partners and others in backing one of the latest unicorns in logistics.

- ReverseLogix: as e-commerce increases, returns are shooting upward, since 30% of online purchases are returned. The reverse logistics market suffers from manual processes, a lack of visibility into returns data and metrics, and a poor customer experience. We believe ReverseLogix has built the first true end-to-end returns management system (RMS).

- Parcel Perform: e-commerce growth is also driving demand for supply chain visibility. Founded by DHL alumni, Parcel Perform understands the market gap in visibility, and is giving consumer brands and marketplaces a powerful tracking solution. We are proud to back them, along with Softbank.

- Everest: as freight markets continue to exhibit volatility, shippers need reliable and high-quality freight management companies. The Everest team has built a tech-enabled truck brokerage and logistics solution that is growing rapidly with blue-chip CPG companies.

- Boa Logistics: medium-sized shippers, especially those with perishable goods, have long been plagued with high delivery costs and poor service levels. Boa Logistics is the largest dedicated temperature-controlled LTL platform in the country serving this niche. Boa is expanding nationwide on the back of a recapitalization by Cambridge in August 2022.

- byrd: Europe is a highly-fragmented market, especially for e-commerce fulfillment. byrd is the leading provider of software-based fulfillment services in 8 countries, and allows brands in the region to sell globally, but be serviced by a centralized tech-enabled partner that is accountable for results.

- Liftit: Another region with major fragmentation and opportunity is Latin America. Liftit built a tech-enabled trucking marketplace servicing B2B customers in Colombia, Mexico and Ecuador, finally bringing visibility, automation and optimization to large enterprise shippers in these countries.

- DeliveryCircle: On-demand deliveries for specialty/large products such as tires and other items have been overlooked by many market participants, and DeliveryCircle has built a strong niche business focusing on this lucrative sector.

- Greenscreens.ai: There has been much talk of AI in transportation. But who is really applying it? Greenscreens.ai has built the first predictive pricing model for truckload freight that actually provides tangible value to customers. Greenscreens.ai has grown nearly 10x over the last 2 years, and now serves over 140 of the top 200 freight brokers.

At Cambridge, we have a simple philosophy: back outstanding CEOs who are building top-quality businesses in all areas of the supply chain arena. Cambridge is willing to fund portfolio companies on a majority or minority basis, and focuses on $10-$50 million investments.

Cambridge Capital is currently seeking new investment opportunities, so please let us know if you would like to discuss how Cambridge may be a fit for your business. For more information, please feel free to contact me at Ben@CambridgeCapital.com.

Perspective at BGSA

On the advisory side, BGSA continues to expand its M&A services. BGSA has earned a reputation as a leader in M&A for transportation, logistics, and supply chain services, and has worked on over 50 transactions in the sector. Clients and transactions have included NFI, C.R. England, GENCO (now FedEx), New Breed (now XPO), and many others.

BGSA continues to play an active role as trusted advisor to major companies in the sector. BGSA’s client NavTrac recently sold to Loadsmart, and several other engagements are currently under way. Please reach out to BGSA if you’d like to discuss deal ideas.

If you would like to discuss acquisitions, divestitures, or other deal ideas, please reach out to Shai Greenwald at Shai@BGSA.com.

Closing Thoughts

In sum, we thank you for being a part of the BGSA Supply Chain ecosystem. We all learn and benefit from the collective wisdom of this outstanding network of CEOs and industry leaders.

To see highlights from 2024’s event, including photos of our amazing attendees, feel free to click here.

If you have feedback on the BGSA Supply Chain Conference, please share it here, so we can continue to improve as we seek to convene the best and brightest in our sector and provide unmatched value for our friends and colleagues who join us.

Please save the date for next year’s BGSA Supply Chain Conference: January 22-24, 2025. Next year we will again return to the Breakers in Palm Beach, for our 19th annual conference!

Meanwhile, we look forward to a successful 2024 for our clients, to a busy year of strategic advisory work with BGSA Holdings, to strong growth for our portfolio companies, and to a few more outstanding platform investments with Cambridge Capital. If you would like to discuss strategic, financial, or other ideas, please feel free to contact me directly at (561) 932-1601 or Ben@CambridgeCapital.com.

Thank you and best wishes for the coming year.

Benjamin Gordon