BGSA Supply Chain Conference 2025 Recap

On behalf of all of us at BGSA Holdings and Cambridge Capital, we wanted to share some highlights of BGSA Supply Chain 2025. For those of you who joined us, we hope you had a great time.

For our 19th annual Supply Chain conference, we returned as always to the Breakers in Palm Beach. Although we endured the coldest week in our two-decade history, we enjoyed the warmth of a truly special supply chain community, and hosted an all-time high of 380 CEOs and leaders across all areas of the supply chain ecosystem.

This record turnout included CEOs from North America, South America, Europe, Asia and Africa. We got to exchange ideas with leaders in logistics, distribution, freight forwarding, truck brokerage, warehousing, trucking, shipping, last mile, fulfillment, and other areas. As technology has become more and more embedded in the supply chain, we met with software all-stars in WMS, TMS, reverse logistics, predictive pricing, digital brokerage, and a host of ecommerce logistics categories. And we got to talk with over 30 of the top supply chain CEOs about their outlook for 2025. This was truly a “Davos for Logistics” week!

2025 Opening Remarks

Benjamin Gordon – Managing Partner, Cambridge Capital – 2025 Opening Remarks and State of the Industry

A Representative List of Speakers and Industry Leaders

For those of you who were not able to attend this year, we wanted to summarize what you missed.

State of the Supply Chain Markets

In 2025, we believe we are about to enter the fourth major wave of change in the modern supply chain world.

- The first wave began in 1956, when Malcom McLean invented the modern shipping container, revolutionizing global trade

- The second wave emerged in 1980, when the Motor Carrier Act of 1980 ushered in an era of deregulation, outsourcing, and competition

- The third wave developed in 1997, when Amazon went public and the Internet age began, transforming supply chain efficiency through digital networks

Many people thought a fourth wave began in 2020, when COVID shortages triggered record shortages and caused companies to rethink their supply chains. Freight rates surged over 100%, the world ran out of commodities ranging from chicken to toilet paper to semiconductor chips, and retailers like Costco, BJ’s, and American Eagle acquired logistics companies to control their networks.

In fact, the opposite occurred. From January 2022 to April 2024, we witnessed the worst freight recession of our lifetimes. Freight rates plunged by 50% from their peak. Transportation volumes dropped by 20%. And we saw record bankruptcies, punctuated by Yellow and Convoy.

Meanwhile, volatility has erupted throughout the world, rippling through supply chains. Critical developments include:

- Russia’s invasion of Ukraine, which has not only decimated Ukraine but has also cost the world economy over $1.6 trillion

- The Red Sea Crisis, prompted by Houthi terror attacks on ships, led to blockades along the Red Sea and Suez Canal, forcing shipping delays of 10-14 days, a 35% increase in lead times, and over $40 billion in freight disruptions

- The Panama Canal drought, which slashed the number of daily ship crossings by 33%, caused delays of up to 21 days, and triggered rerouting costs of 15-20%

- Labor cost shocks, spearheaded by the International Longshoremen’s Association (ILA) strike threats, which caused a 12% surge in inventory stockpiling and massive slowdowns in critical hubs like Houston and Savannah

- Tariff expansion, including 10% increases on US-China tariffs, the China export restrictions on rare earth minerals needed for vehicles and electronics, proposals for 25% tariffs on Canada and Mexico, and more.

So what is next? We believe 2025 will usher in a fourth great cycle: the pendulum will swing back from long-range globalization to compressed supply chains. In just two years, manufacturing construction spending in the U.S. has increased 86%, to $237 billion. A few examples:

- General Motors has announced investments to increase battery cell production

- Intel is investing heavily in the U.S. with plans for new chip factories, with a $12 billion investment in facilities near Phoenix

- GE Appliances is expanding its U.S. production, investing in new plants, and increasing spending on American suppliers

- Harley-Davidson has announced plans to bring some manufacturing back to the US

- Micron Technology is investing in Virginia with a significant project that will create jobs and strengthen America’s semiconductor supply chain

- Panasonic Energy aims to eliminate its supply-chain dependence on China for electric vehicle batteries made in the United States

The ripple effects for the supply chains are clear. We are in the early innings of a wave of growth for domestic transportation, logistics, and distribution companies. Meanwhile, the increasingly complex thicket of rules and regulations for cross-border commerce creates continued opportunity for global trade management software companies.

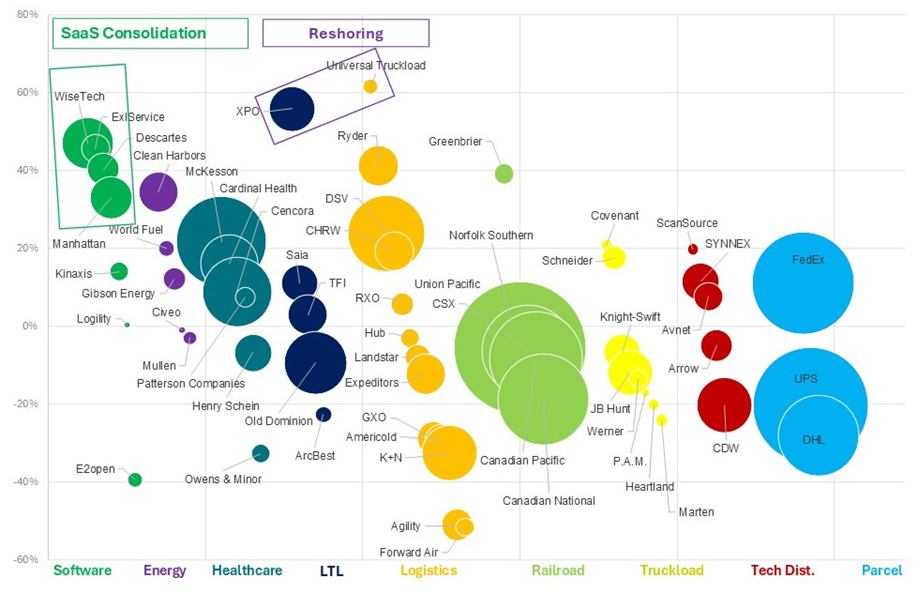

The data bears this out. When we look at 2024’s winners in terms of market value, two standouts jump out.

2024’s Winners in Market Value

Source: Capital IQ, BGSA

First, global trade management software leaders WiseTech and Descartes continued their success. WiseTech soared 47%, gaining $8.0 billion of value as they acquired more competitors and maintained a staggering 42% EBITDA margin. Descartes was not far behind, adding 40%. These two companies were bellwethers of the supply chain technology sector, which as a category grew 35%, outperforming the Supply Chain Index by 39%.

Second, domestic supply chain companies Universal and XPO were the two highest growing companies in terms of stock price performance. Universal grew 62%, fueled by their shifting focus to US contract logistics, and acquisition of Parsec. XPO expanded by 56% and added $6.8 billion of market value, as they strengthened their leadership in LTL and gained price increases accordingly.

The Outlook for 2025

What do we expect going forward?

As we begin the fourth wave of compressed supply chains, six key themes emerge:

- Freight companies that invest in the early innings of the great American freight recovery

- Domestic supply chain leaders that can accelerate their growth as companies relocate their manufacturing closer to home

- E-commerce logistics companies that can help consumers improve their buying experience

- Companies that can help their clients navigate complex global trade amidst record volatility

- Fast followers that can adopt technology and deploy it as a competitive weapon

- AI providers that can aggregate the most data, sanitize the biggest data sets, train their models to be the most accurate, and deliver superior value

Let’s explore each of these trends.

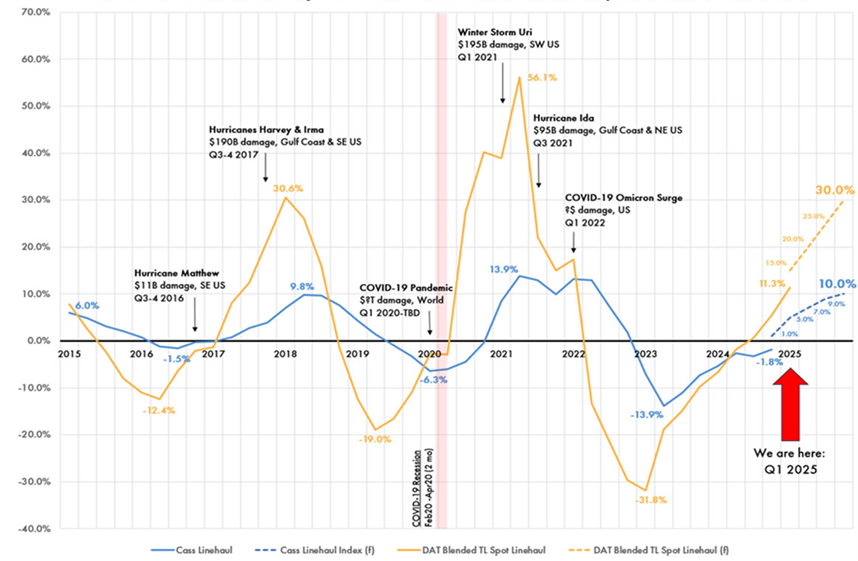

First, the US freight recession is officially over. The freight cycle peaked in January 2022, at a spot TL linehaul rate of $2.77/mile per Pickett Line Research. It hit bottom in April 2024, at $1.60/mile. Since then, the spot index has climbed 17%. In 2025, Pickett forecasts a 30-50% increase.

The US Truckload Market Rate Cycle

Source: Pickett Line Research

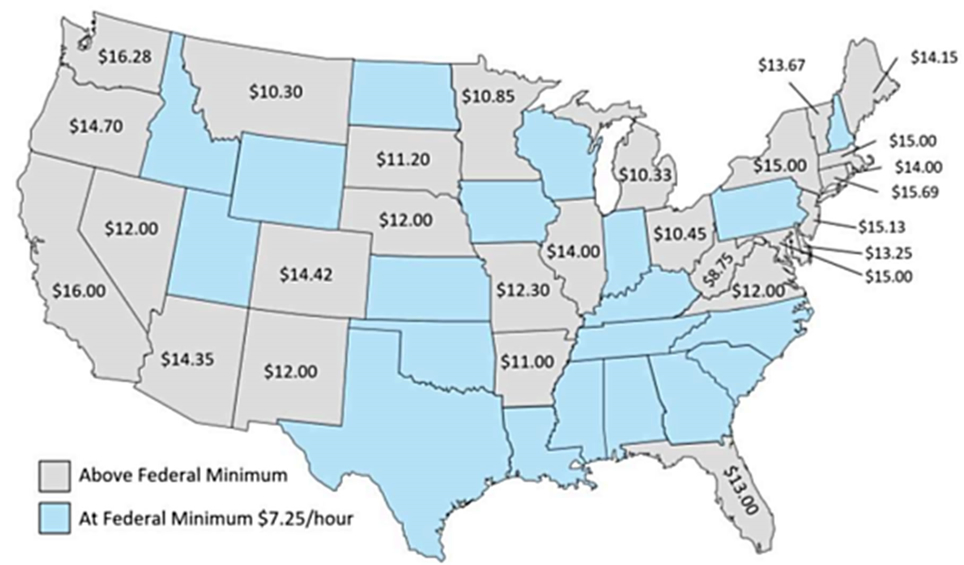

Second, domestic supply chain leaders are already beginning to benefit. We see particularly strong growth in the South and Midwest, given lower labor costs and superior supply chain networks. An increasing number of US manufacturing companies are investing in the South, including automotive OEMs. They are drawn by inexpensive labor, abundant resources, and historical manufacturing. The Midwest is also gaining ground. And Arizona is picking up investment in the semiconductor arena. Supply chain companies that target these markets are gaining ground.

Labor Costs: Minimum Wage per State

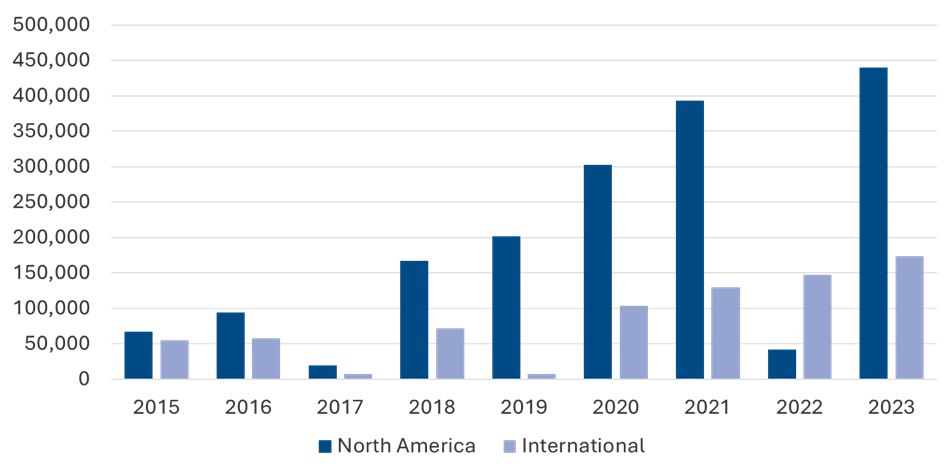

Third, as e-commerce continues to grow, winners include supply chain providers that can give consumers a superior buying experience. An obvious winner is Amazon, which continues to scale up its fulfillment footprint. In the last 8 years, Amazon has grown its North American fulfillment square footage by 7x, which is more than double its rate of international growth.

Amazon Fulfillment Square Footage (in Thousands)

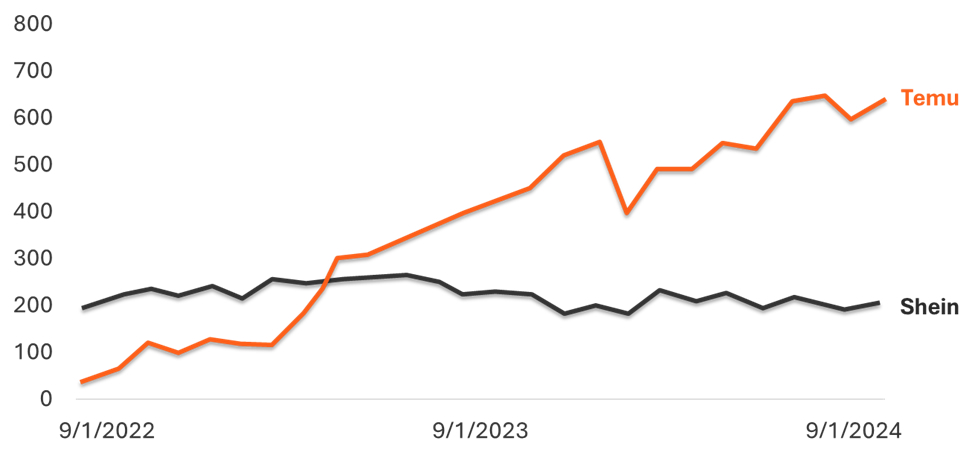

Aside from Amazon, other companies are gaining ground as well. New e-commerce giants are emerging. Temu, for instance, is overtaking Shein.

Shein and Temu.com Total Website Visits (in MM)

This growth in e-commerce produces opportunities for companies in fulfillment, post-purchase tracking and visibility, last mile, and returns. At Cambridge Capital, we see beneficiaries here including Byrd (fulfillment), Parcel Perform (post-purchase), Bringg, and DeliveryCircle (last mile), and ReverseLogix (returns).

Fourth, growing cross-border complexity is fueling growth in global trade management software. Increasingly, this is becoming a duopoly. Descartes and WiseTech are in a race for worldwide supremacy. Combined, the two companies are worth $35 billion and lead their fields.

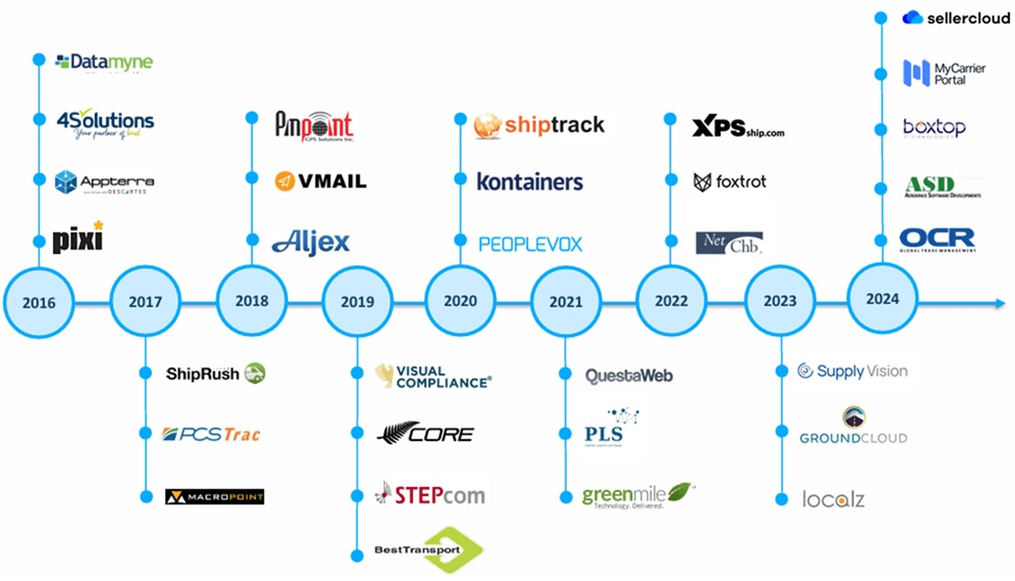

In 2016, WiseTech went public. Since then, they have created $24 billion of value, skyrocketing by 3125%. Meanwhile, over the same timeframe, Descartes created $9 billion of value, shooting up 603%. In both cases, acquisitions accelerated their growth, as they sought to create complete end-to-end global trade solutions. In the case of Descartes, they have bought 34 companies over this timeframe. Clearly, the model is working.

Descartes Acquisitions, 2016-2024

Source: Descartes investor relations

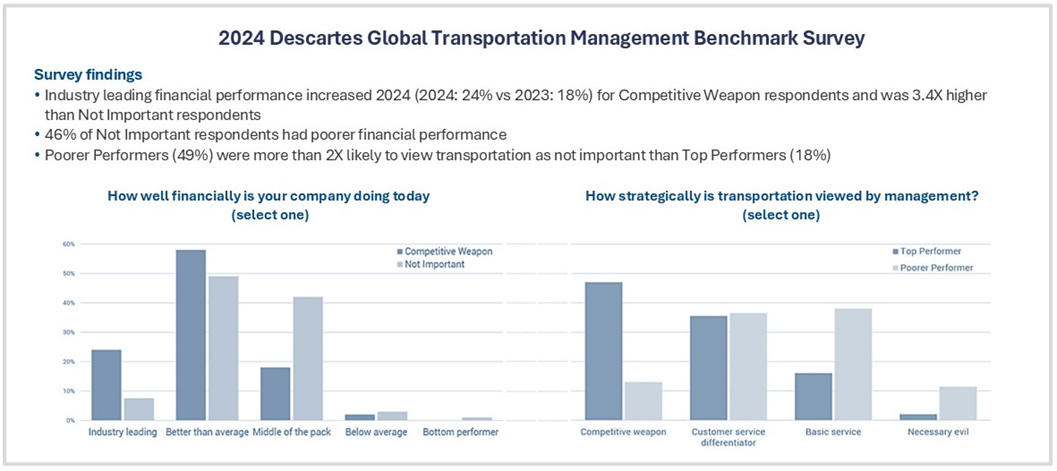

Fifth, if you can’t beat them, join them. For enterprises, we see increasing evidence that “fast followers” in technology are gaining a competitive advantage. Descartes’ annual benchmark survey showed that companies who invest more in technology and view their transportation as a “competitive weapon” are 3.4x more likely to be a top financial performer.

2024 Descartes Global Transportation Management Benchmark Survey

Sixth, AI is becoming increasingly important. On November 30, 2022, ChatGPT was released. Since then, it has rapidly become adopted, first by consumers, and then by businesses. The next wave of AI is underway, with industrial applications. In transaction-intensive industries like banking and healthcare, companies are using AI to process high volumes of transactions. And in transportation, we are seeing applied AI winners emerge in multiple arenas. For example:

- In predictive pricing, Cambridge Capital’s Greenscreens.ai has emerged as the leader, with close to 200 of the top 300 truck brokerage firms as customers, and over $30 billion of volume coursing through its system. With more data, the algorithms become ever more accurate and valuable.

- Here at the BGSA Supply Chain Shark Tank, HappyRobot is a finalist that is using AI to automate phone calls and workflow

- Levity is using AI to streamline email inboxes

- Waymo is deploying AI to power its driverless trucking

The Capital Markets

What are the implications for M&A, investment, and capital markets?

First, we believe 2025 will be a record year for M&A after a three-year lull. After a recession, there is always a great reset in expectations. Sellers remember the premium prices of 2021. Buyers know the markets have repriced, but are waiting for sellers to agree. The bid-ask gap typically takes 1-2 years to narrow. This is happening now. In 2025, we are seeing a boom in activity, at BGSA (our investment bank), Cambridge Capital (our private equity firm), and across the markets.

Second, many global giants are divesting or spinning off divisions to focus on their core business. UPS decided to exit freight brokerage with the sale of Coyote Logistics to RXO. FedEx announced plans to spin off its LTL business, FDX Freight, to concentrate on its core parcel strategy. And TransForce just announced intentions to separate into two pure-plays: a truckload company (SpinCo) and an LTL/Parcel/Logistics company (RemainCo). These strategies are reminiscent of what XPO did in 2022 when the business separated into an LTL company (XPO), truck broker (RXO), and contract logistics provider (GXO).

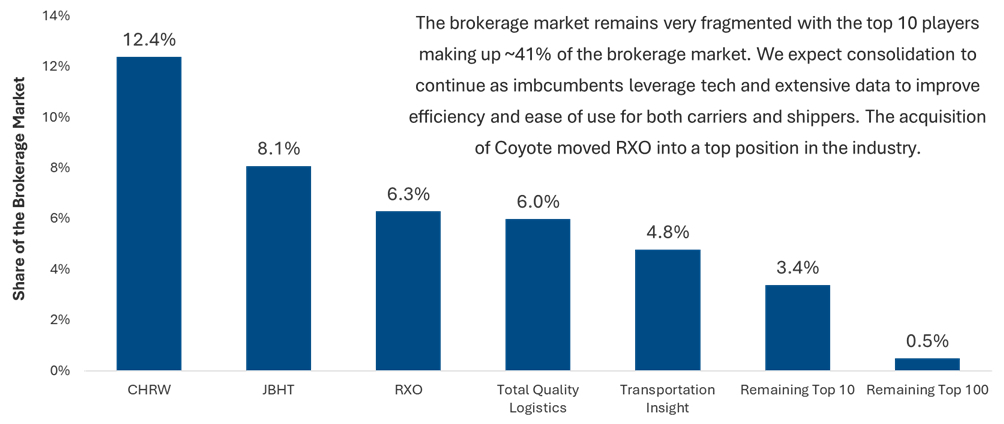

Third, consolidators are seeking to use 2024-2025 as an opportunity to double down on growth in their core markets, in a quest to become #1. Serial acquirors like RXO, Descartes, WiseTech, TFI, CMA CGM, and others will use 2025 to accelerate.

In truck brokerage, RXO vaulted up to the #3 position with the acquisition of Coyote. And yet they still have plenty of room for opportunities, since the top 10 players own just 41% of the brokerage market.

The US Truck Brokerage Market Remains Fragmented

Fourth, we will find that the smartest buyers seek areas of strategic differentiation. For instance, reverse logistics is growing in importance. Consumers returned 17% of purchases last year, representing $890 billion, double the amount from 5 years ago. In 2023, UPS bought Happy Returns. To kick off 2025, DHL just acquired Inmar Intelligence. Why? DHL believes the high margin returns capability will help DHL differentiate, and enable the company to bundle sales with its high-volume transportation/logistics offering.

Our Point of View at BGSA and Cambridge

We believe 2025 will be a robust year in the supply chain sector. To that end, we are positioned to work with our clients and portfolio companies to help them achieve continued success.

Our M&A advisory firm, BGSA, continues to expand its investment banking capabilities. BGSA has earned a reputation as a leader in M&A for transportation, logistics, and supply chain services, and has worked on over 50 transactions in the sector over the past 20 years. Clients include YRCW, NFI, GENCO (now FedEx), New Breed (now XPO), and many others. If you would like to discuss acquisitions, divestitures, or other deal ideas, please reach out to Shai Greenwald at Shai@BGSA.com.

Meanwhile, our affiliated private equity firm, Cambridge Capital, continues to invest in outstanding platforms in the logistics and supply chain technology arena. Cambridge has a simple philosophy: back outstanding CEOs who are building top-quality businesses in the supply chain arena. Cambridge is willing to invest on a majority or minority basis and focuses on $10-$50 million checks.

Over the last 12 years, Cambridge has made 12 investments, beginning with XPO.

Perspective at Cambridge Capital

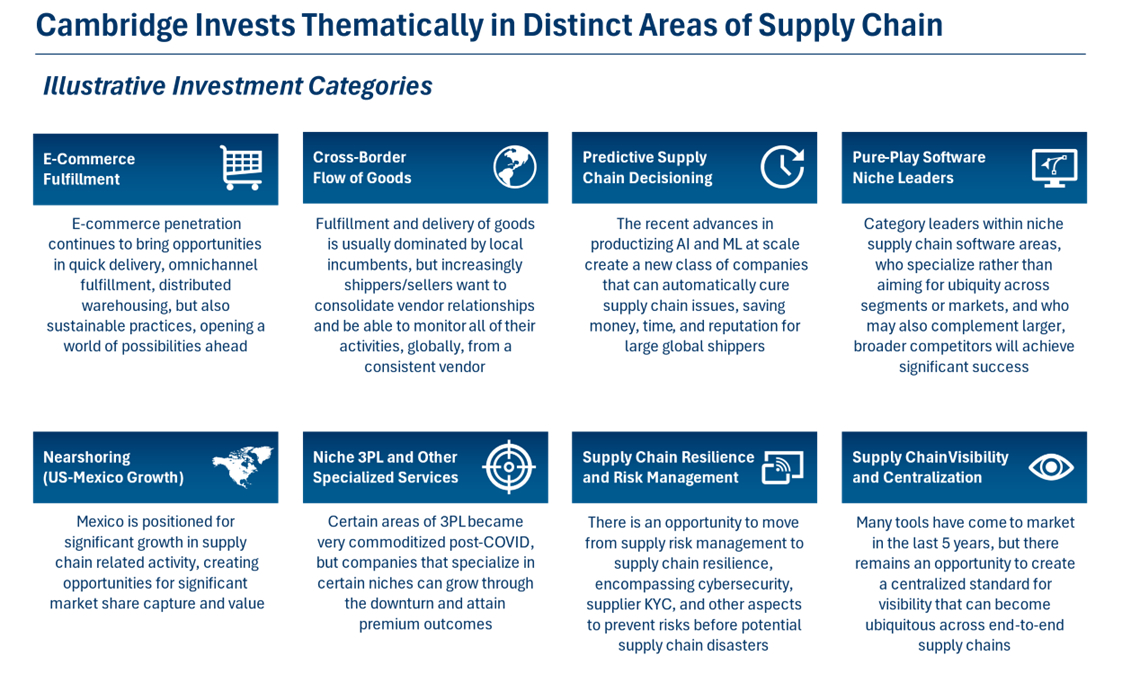

At Cambridge Capital, we believe we are in the early innings of high-growth digital supply chains as well as compressed supply chains. Some of the key themes we see include last-mile logistics, AI to automate supply chains, supply chain visibility, reverse logistics, and tech-enabled “man + machine” services. To illustrate these ideas, please see below.

At Cambridge, we believe in putting our money where our mouth is. We have made a series of investments in companies in these arenas. They include the following:

- Greenscreens.ai: There has been much talk of AI in transportation. But who is really applying it? Greenscreens.ai has built the first predictive pricing model for truckload freight that actually provides tangible value to customers. Greenscreens.ai has grown nearly 10x over the last 3 years, and now serves over 200 of the top 300 freight brokers.

- Parcel Perform: e-commerce growth is driving demand for supply chain visibility. Founded by DHL alumni, Parcel Perform understands the market gap in visibility and is giving consumer brands and marketplaces a powerful tracking solution. We are proud to back them, along with Softbank.

- Bringg: for the B2C supply chain, last-mile delivery comprises 41% of total costs. In last-mile logistics SaaS, we believe Bringg is emerging as the market leader. We have backed them since 2016, have watched them scale up from a startup to the incumbent, and welcomed Insight Partners and others in backing one of the latest unicorns in logistics.

- ReverseLogix: as e-commerce increases, returns are shooting upward since 30% of online purchases are returned. The reverse logistics market suffers from manual processes, a lack of visibility into returns data and metrics, and poor customer experience. We believe ReverseLogix has built the first true end-to-end returns management system (RMS).

- Everest: as freight markets continue to exhibit volatility, shippers need reliable and high-quality freight management companies. The Everest team has built a tech-enabled truck brokerage and logistics solution that is growing rapidly with blue-chip CPG companies.

- byrd: Europe i a highly fragmented market, especially for e-commerce fulfillment. byrd is the leading provider of software-based fulfillment services in 8 countries and allows brands in the region to sell globally, but be serviced by a centralized tech-enabled partner that is accountable for results.

- Liftit: Another region with major fragmentation and opportunity is Latin America. Liftit built a tech-enabled trucking marketplace servicing B2B customers in Colombia, Mexico, and Ecuador, finally bringing visibility, automation, and optimization to large enterprise shippers in these countries.

- DeliveryCircle: On-demand deliveries for specialty/large products such as tires and other items have been overlooked by many market participants and DeliveryCircle has built a strong niche business focusing on this lucrative sector.

- STAT: STAT Recovery is a machine learning-based invoice audit software platform helping retail suppliers optimize revenue by reducing improper deductions and compliance fines from large retailers. We invested to support their continued growth with new brands and retailers.

Cambridge Capital is currently seeking new investment opportunities, so please let us know if you would like to discuss how Cambridge may be a fit for your business. For more information, please feel free to contact me at Ben@CambridgeCapital.com.

Perspective at BGSA

On the advisory side, BGSA continues to expand its M&A services. BGSA has earned a reputation as a leader in M&A for transportation, logistics, and supply chain services, and has worked on over 50 transactions in the sector. Clients and transactions have included NFI, C.R. England, GENCO (now FedEx), New Breed (now XPO), and many others.

BGSA continues to play an active role as trusted advisor to major companies in the sector. At the moment, six engagements are currently under way. Please reach out to BGSA if you’d like to discuss deal ideas.

If you would like to discuss acquisitions, divestitures, or other deal ideas, please reach out to Shai Greenwald at Shai@BGSA.com.

Closing Thoughts

In sum, we thank you for being a part of the BGSA Supply Chain ecosystem. We all learn and benefit from the collective wisdom of this outstanding network of CEOs and industry leaders.

To see highlights from 2025’s event, including photos of our amazing attendees, feel free to click here.

If you have feedback on the BGSA Supply Chain Conference, please share it here, so we can continue to improve as we seek to convene the best and brightest in our sector and provide unmatched value for our friends and colleagues who join us.

Please save the date for next year’s BGSA Supply Chain Conference: January 21-23, 2026. Next year we will again return to the Breakers in Palm Beach, for our 20th annual conference!

Meanwhile, we look forward to a successful 2025 for our clients, to a busy year of strategic advisory work with BGSA Holdings, to strong growth for our portfolio companies, and to a few more outstanding platform investments with Cambridge Capital. If you would like to discuss strategic, financial, or other ideas, please feel free to contact me directly at (561) 932-1601 or Ben@CambridgeCapital.com.

Thank you and best wishes for the coming year.

Benjamin Gordon

Ben@CambridgeCapital.com

(561) 932-1601